The International Monetary Fund (IMF) has projected that India’s economy will expand by 6.6 percent in 2025, moderating to 6.2 percent in 2026, according to its latest Regional Economic Outlook for the Asia-Pacific Region.

Announcing the forecast at a press conference during the IMF and World Bank Annual Meetings in Washington D.C. on October 16, 2025, Krishna Srinivasan, Director of the IMF’s Asia and Pacific Department, said India will remain the fastest-growing major emerging economy despite tariff pressures.

“The Indian economy is projected to grow at a healthy pace of 6.6 percent this year, once again at the fastest clip among major emerging economies, with welcome Goods and Services Tax reforms helping offset the adverse impact of tariffs,” Srinivasan said. “Growth is projected to moderate to 6.2 percent next year owing to higher tariffs.”

Srinivasan, joined by Thomas Helbling, Deputy Director of the department, emphasized the region’s need for deeper trade integration, structural reforms, and stronger regional cooperation to sustain growth and resilience.

India: Strong Domestic Drivers, Trade Headwinds

Responding to a query about India’s domestic driven economy and ongoing tariff-related challenges, Srinivasan noted that the country’s domestic momentum remains robust.

“In terms of the growth, 6.6 percent this year. We’ve had some headwinds and some tailwinds. The headwinds, of course, were from tariffs, but on the tailwinds, the first quarter came out at 7.8 percent, much better than most people expected,” he told South Asian Herald.

He added that the 2026 projection of 6.2 percent is based on tariffs remaining at 50 percent:

“The way we do our forecast is based on announced policies. So, if India reaches a trade agreement with the U.S. when tariffs are lower, there’s an upside potential to growth next year.”

Srinivasan stressed that “tariffs do matter,” particularly for labor-intensive sectors such as garments, leather, and gems and jewelry, which could affect employment opportunities. He called for balancing external and domestic demand while deepening India’s participation in global supply chains.

“India has signed free-trade agreements with the U.K. and is pursuing agreements with the EU and Australia,” he said. “Those are all the right things to do because you also want to diversify your export markets so that, any shock in one particular country, you have other ways to diversify that.”

He added that “deep structural reforms” are essential for India to achieve its aspiration of 8 percent growth and developed-economy status.

“India’s fundamentals are pretty strong – growth is good, inflation’s coming down, and the fiscal deficit is well-managed,” Srinivasan said. “For India to become a developed country, it has to fire on all cylinders – strengthen domestic demand and integration within India.”

He pointed to GST reforms as a key driver of consumption and domestic demand and urged greater trade liberalization and labor-market flexibility to help India scale up and compete with China. Removing excessive regulations, he said, would unleash the private sector’s potential.

Sri Lanka: Stay the Course on Fiscal Reforms

Discussing Sri Lanka’s recovery, Helbling said the country has made significant strides since its economic crisis.

“After a deep recession during the crisis, Sri Lanka has now implemented a homegrown reform program and benefits from very strong growth – 5 percent last year. We estimate 4.2 percent this year and the next year going towards potential of 3 percent,” he noted.

Helbling advised continued program implementation to consolidate these gains, emphasizing the importance of fiscal discipline and restructuring state-owned enterprises to reduce budgetary risks.

Srinivasan echoed that message, noting “Sri Lanka has come a long way from where it was a few years ago. The advice we would say is stay the course. You’ve done the difficult part; continue with the reforms and you will see the benefits.”

Addressing the role of past fiscal mismanagement and unproductive infrastructure spending in Sri Lanka’s crisis, Helbling said the key is to build sound macroeconomic and governance institutions.

“Public investment management is a key part of sound fiscal frameworks. The government has also subscribed to governance reform, which it supports under the program. Further progress along the benchmarks laid out in the program is important,” he said.

Bangladesh: Tariff Uncertainty and Financial Sector Weakness

The IMF has lowered Bangladesh’s growth forecast for FY 2025-26 to 4.9 percent, down from 5.4 percent earlier, citing tighter policies, tariffs, and political and financial-sector uncertainties.

“The policy mix has been tighter, and tariffs and uncertainty have played a big role,” Srinivasan said.

“In addition to the tariff-related uncertainty, there are two other uncertainties bearing on Bangladesh’s economic prospects – the upcoming elections and significant weakness in the financial sector, which will affect the availability of credit.”

Inflation in Bangladesh is expected to remain high, “at 8.5 percent by end FY 26 and that’s primarily driven by supply-side shocks earlier this year,” he said.

An IMF team is set to visit Dhaka soon for the next program review. Srinivasan emphasized that revenue mobilization and financial-sector reform remain central to Bangladesh’s adjustment strategy. “Bangladesh needs to continue with key reform areas on fiscal – where revenue mobilization is a key part – and on the financial sector. These are key aspects we’re looking at as part of the forthcoming review.”

Asia-Pacific Region: Resilient but Slowing

Overall, the IMF said the Asia-Pacific region continues to outperform expectations despite global headwinds.

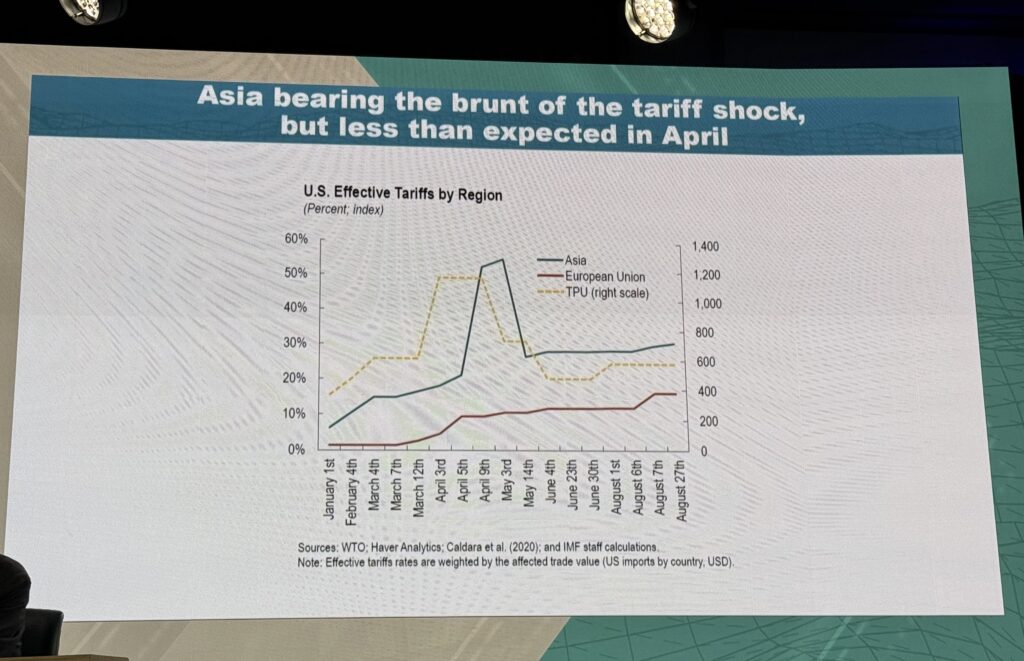

“Economic activity is holding up better than expected in April, despite the region bearing the brunt of U.S. tariffs and policy uncertainty remaining high,” Srinivasan said. “We project the region to grow by 4.5 percent in 2025 and moderate to 4.1 percent in 2026. Inflation is expected to remain muted in most countries.”

Asia will once again contribute around 60 percent of global growth this year and next. Yet, Srinivasan cautioned that the region’s growth momentum has slowed compared with the previous decade.

He cited several structural challenges – aging populations, weaker productivity, pandemic scars, and youth unemployment – that are eroding economic sentiment.

“Risks to the current outlook are to the downside,” he warned. “The dust on tariffs has not yet settled. They could still increase. Risk premia and interest rates could rise again, especially if trade policy uncertainty or geopolitical tensions intensify.”

Higher borrowing costs could amplify debt vulnerabilities and stifle growth, he added.

Policy Priorities: Cushioning Tariffs, Building Resilience

In the face of these risks, the IMF advised that countries where inflation is below target could lower interest rates and use temporary, well-targeted fiscal measures to protect vulnerable households and viable firms affected by tariffs.

Srinivasan underscored the need for upgraded medium-term fiscal frameworks to prepare for future shocks and manage long-term spending pressures. He also urged policies to make growth more inclusive and resilient by rebalancing toward domestic demand and strengthening social safety nets.

“Countries need to make growth more inclusive and resilient by rebalancing toward domestic demand, especially consumption, through stronger social safety nets and, where needed, balance-sheet repair,” he said.