S&P Global Ratings on July 25, 2025, affirmed Bangladesh’s long-term sovereign credit rating at ‘B+’ and its short-term rating at ‘B’, with a stable outlook, citing improved external liquidity and steady policy reforms. The decision underscores Bangladesh’s efforts to stabilize its economy after a turbulent year marked by political upheaval and external trade pressures.

The ratings agency noted that Bangladesh’s official foreign exchange reserves have begun to recover following a series of macroeconomic adjustments over the past 18 months, including a shift to a more flexible exchange rate, depreciation of the taka, and tighter monetary policy. These measures have helped the country rebuild liquidity and meet conditions set by the International Monetary Fund (IMF) under its Extended Fund Facility.

External Liquidity on the Mend

Foreign exchange reserves rose by nearly $5 billion in fiscal 2025 to $26.7 billion, covering roughly 4.1 months of current account payments, compared with 3.3 months a year earlier. Remittance inflows, a key source of foreign currency, surged by nearly 27 percent in fiscal 2025, while exports grew by 9.4 percent in the July-May period, according to S&P.

“Policy adjustments are beginning to bear fruit,” S&P said, adding that the central bank’s adoption of a more flexible exchange rate regime in May 2025 has improved transparency and restored confidence in the currency. The central bank’s key policy rate remains at a multi-year high of 10 percent to curb still-elevated inflation, which eased to 8.5 percent in June from 9.7 percent a year earlier.

The ratings agency projects Bangladesh’s current account deficit will widen slightly to 1.4 percent-1.9 percent of GDP over the next three years as domestic demand recovers and imports pick up. However, improved reserve coverage and ongoing IMF-backed reforms are expected to support stable liquidity.

Political Flux Adds Uncertainty

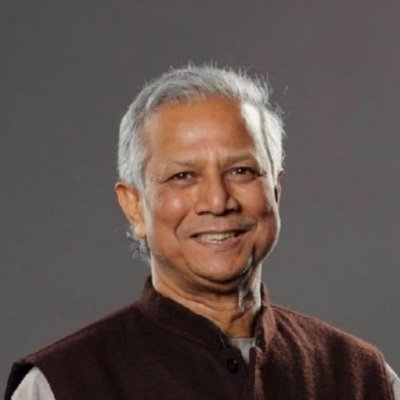

Bangladesh’s political landscape remains fragile following the collapse of the Awami League government in July 2024. A caretaker administration led by Nobel laureate Muhammad Yunus is overseeing day-to-day governance, with general elections tentatively scheduled for April 2026.

The political crisis triggered a sharp economic slowdown in late 2024, but growth is expected to rebound to 6.1 percent over the next three years as domestic demand strengthens. Still, policy predictability and foreign direct investment remain constrained until a stable elected government is formed.

“The political outlook is a key variable,” S&P warned. “Institutional weaknesses and an uncertain policy environment could slow fiscal and structural reforms, particularly in revenue generation and infrastructure development.”

Trade Headwinds Loom

While Bangladesh’s garment industry – which accounts for over 85 percent of merchandise exports – remains competitive, external trade risks are mounting. A proposed 35 percent U.S. tariff on Bangladeshi imports, slated to take effect on Aug. 1, 2025, could sharply erode export competitiveness unless mitigated by new trade agreements.

In fiscal 2024, the U.S. accounted for 17.5 percent of Bangladesh’s exports, with ready-made garments comprising nearly 88 percent of shipments to that market. S&P cautioned that higher tariffs could squeeze the labor market and foreign exchange earnings, threatening the fragile recovery.

Credit Profile: Strengths and Constraints

Bangladesh’s ratings remain capped by its modest per capita income, estimated at $2,620 for fiscal 2025, and a narrow revenue base. The government’s interest burden is high at about 26 percent of revenues, leaving little fiscal room to maneuver. Net general government debt is projected to average 35 percent of GDP through fiscal 2028, with over 40 percent of the debt stock denominated in foreign currency, making it vulnerable to taka depreciation.

Nevertheless, S&P cited Bangladesh’s resilient growth record – with a 10-year average real per capita GDP growth rate of 4.3 percent, well above the median for similarly rated sovereigns – as a key support. Strong remittance flows, a competitive export base, and financial assistance from multilateral and bilateral partners also bolster the country’s external profile.

Outlook: Balanced Risks

The stable outlook reflects S&P’s expectation that Bangladesh’s real per capita GDP growth will remain strong and that its external position will stabilize despite global trade pressures.

A downgrade could be triggered if narrow net external debt consistently exceeds 100 percent of current account receipts or if foreign reserves fail to build further. Conversely, an upgrade is possible if fiscal and external metrics improve materially – for example, through stronger-than-expected remittance flows, a reduction in the fiscal deficit, and sustained reserve accumulation.

IMF Support and Fiscal Challenges

Bangladesh is implementing a 42-month reform agenda under the IMF’s Extended Credit Facility, Extended Fund Facility, and Resilience and Sustainability Facility programs. In June 2025, the IMF disbursed $884 million under the EFF and $453 million under the RSF after completing its combined third and fourth reviews. Key reforms include reducing reliance on costly National Saving Certificates (NSCs), improving GDP data timeliness, and adjusting petroleum pricing.

The fiscal deficit is projected to remain steady at 4.6 percent of GDP over the next three years, but revenue mobilization remains a challenge. S&P views the country’s banking sector as a source of contingent risk, particularly state-owned commercial banks, which account for under 30 percent of total banking assets but have non-performing loan ratios of around 40 percent.

Looking Ahead

Bangladesh is set to graduate from Least Developed Country status in 2026, a milestone that could attract new investment but also expose the economy to tougher trade rules and reduced preferential market access. The ability to navigate this transition while managing external shocks, such as U.S. tariffs, will be critical to maintaining its credit profile.