India has notched up an unusual hat-trick of sovereign credit rating upgrades in just five months, strengthening its profile as a rare bright spot in a volatile global economy. Yet the flurry of positive moves has revived a debate over whether rating agencies are belatedly aligning with fundamentals that investors already took for granted.

On Friday, Japan’s Rating and Investment Information, Inc. (R&I) lifted India’s long-term foreign currency issuer rating to BBB+ from BBB, with a stable outlook. The decision follows Standard & Poor’s upgrade to BBB in August and Morningstar DBRS’ revision to BBB in May.

The upgrades push India more firmly into the investment-grade camp, reducing perceived risk for global investors and lowering potential borrowing costs. “Three upgrades in five months show growing international recognition of India’s robust and resilient macroeconomic fundamentals,” India’s Finance Ministry said in a statement.

Domestic resilience amid global uncertainty

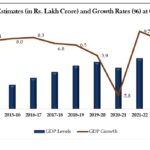

The R&I report underlined why India is gaining traction with global assessors. The economy expanded 6.5 per cent in FY2024 and 7.8 per cent in the April–June quarter of 2025, even as advanced economies struggled with slower growth. The Reserve Bank of India projects FY2025 growth at 6.5 per cent, and R&I expects mid-6 per cent rates in subsequent years.

Crucially, India’s growth is powered by domestic demand, which shields it from global turbulence. When Washington imposed a 50 per cent tariff on certain Indian exports this year, the agency judged the impact to be limited, given India’s relatively low dependence on the U.S. market.

External balances have also held up. The current account deficit narrowed to under 1 per cent of GDP in FY2024, supported by services surpluses from IT and business outsourcing, along with steady remittances. Foreign reserves remain substantial, and external debt is modest relative to GDP.

On the fiscal side, the Centre’s deficit narrowed to 4.8 per cent of GDP in FY2024, with a 4.4 per cent target for FY2025. Strong tax revenues and cuts in subsidies have helped offset higher public investment. Combined central and state government debt has fallen to around 80 per cent of GDP, a level R&I described as “manageable” given domestic ownership and strong nominal GDP growth.

Comparisons with China and peers

For rating agencies, India’s trajectory contrasts sharply with China’s. While India is moving up the ladder, China faces rising investor caution due to slowing growth, property-sector strains, and rising local government debt. Beijing’s sovereign rating remains stronger, but the growth momentum that once justified it has dimmed.

Elsewhere in the emerging world, many economies have seen downgrades or warnings amid commodity price swings, fiscal slippage, and tighter global financing. Brazil and South Africa, for instance, remain mired in lower investment-grade or sub-investment categories, weighed down by structural deficits and political volatility.

By comparison, India’s steady tax collections, services-led external earnings, and demographic dividend have reassured markets. Its prospective inclusion in major global bond indices adds further to its appeal, ensuring foreign portfolio flows even without rating upgrades.

“India is finally being recognized as a durable growth story,” said a Hong Kong-based strategist. “But in truth, markets priced this in years ago—these rating moves are lagging indicators rather than leading ones.”

Reforms and political risks

Much of the agencies’ optimism rests on Prime Minister Narendra Modi’s policy thrust: expanding infrastructure, easing regulations, cutting energy import dependence, and attracting foreign manufacturers. The upcoming simplification of the goods and services tax (GST) is seen as revenue-negative in the short term but potentially positive for consumption.

Still, reforms come with political risks. With several state elections ahead and national polls due in 2026, the pressure to ramp up welfare spending could test fiscal consolidation. “The challenge is whether India can maintain prudence in a pre-election environment,” said a Delhi-based economist at a European bank.

Global backdrop: cautious optimism

The upgrades arrive in a climate of broader ratings downgrades. Many emerging markets have struggled with rising borrowing costs as the U.S. Federal Reserve and other central banks held rates higher for longer. Trade frictions, geopolitical conflicts, and a slowing China have added to the risks.

Against this backdrop, India’s stability stands out. Unlike oil exporters whose fiscal positions swing with crude prices, or commodity importers like Turkey struggling with currency volatility, India has managed to keep both fiscal and external balances in check. Its service surplus and inward remittances provide buffers few peers can match.

Are agencies behind the curve?

Critics argue that agencies have long undervalued India’s credit profile. Despite being the world’s fastest-growing large economy, India’s sovereign rating hovered barely above “junk” for years. Even with the latest upgrades, India still trails China, South Korea, and even smaller economies such as Malaysia.

“Rating agencies are playing catch-up,” said a Mumbai-based fund manager. “Markets, bond spreads, and investor flows have treated India as a stable investment-grade borrower for years. These moves are more about optics than real change.”

The criticism is not new. Agencies’ credibility took a hit during the 2008 financial crisis, when they misjudged risks in structured products. Since then, sovereigns have often bristled at being subject to their verdicts. Still, governments welcome upgrades when they come, as they help lower borrowing costs and attract new classes of investors.

Balancing growth and stability

For India, the triple upgrades offer validation, but not a free pass. R&I warned that reaching New Delhi’s goal of becoming a developed economy by 2047 will require faster growth while simultaneously tackling poverty and unemployment. Fiscal consolidation must continue, even as public investment rises.

The path ahead will hinge less on what rating agencies do and more on whether policymakers sustain reforms, curb populist temptations, and manage external risks. For now, India enjoys rare momentum in an unsettled world—an economy large enough to matter and steady enough to command fresh respect.

![sovereign credit rating-ai-generated[1].jpg](https://southasianherald.com/wp-content/uploads/2025/09/sovereign-credit-rating-ai-generated1.jpg-1170x655.jpeg)