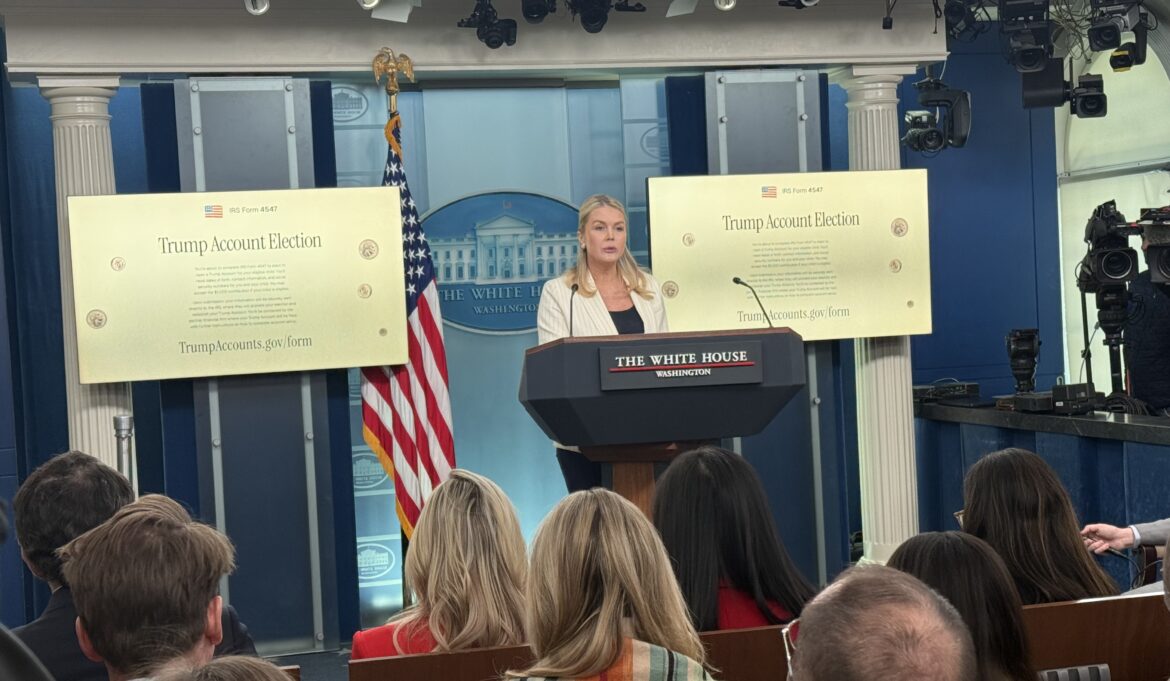

The White House has announced that parents nationwide can now apply to open a “Trump account” for their child through trumpaccounts.gov by completing IRS Form 4547.

Speaking at the White House press briefing on February 10, Press Secretary Karoline Leavitt said, “Trump accounts are special investment accounts aimed at providing American children with a jumpstart on building wealth for life. They have all the tax advantages as a traditional IRA account but are specifically tailored to build wealth the moment a child is born.”

According to Leavitt, children born between January 1, 2025, and December 31, 2028, are eligible to receive $1,000 from the U.S. Treasury to fund their accounts under the initiative introduced by President Donald Trump. Parents, guardians, and nonprofit organizations may contribute up to $5,000 annually, while employers may contribute up to $2,500 per year per employee.

“President Trump believes there is no better investment than investing in our nation’s children,” she said. “If you are a parent who maximizes contributions to your child’s Trump account, it’s projected value could reach nearly $1.1 million by the time your child turns 28 years old, based on average historical stock market returns.”

Leavitt added that it is “safe to say” the accounts would provide a “substantial” financial head start for the next generation. She also cited recent stock market performance, attributing it to the administration’s pro-growth policies, and said the timing was favorable for families to enroll.

Referring to broader retirement savings trends, Leavitt said Americans’ 401(k) plans and retirement accounts are strengthening and expressed confidence that the new children’s investment accounts would follow a similar trajectory.

In addition to the investment initiative, Leavitt outlined several upcoming policy announcements. She said President Trump would promote “Clean Beautiful Coal” on February 11 as a reliable and affordable energy source, particularly during peak demand periods such as recent winter storms that affected hundreds of millions of Americans.

“The President will discuss how Clean Beautiful Coal is not only keeping the lights on in our country, but also driving down the cost of electricity across the country as well,” she said.

Leavitt also announced that on February 12, the President would be joined by Environmental Protection Agency Administrator Lee Zeldin to formalize the “rescission” of the 2009 Obama-era Endangerment finding.

“This will be the largest deregulatory action in American history, and it will save the American people $1.3 trillion in crushing regulations,” she said, adding, “The bulk of the savings will stem from reduced costs for new vehicles, but the EPA projecting average per vehicle savings of more than $2,400 for popular light duty cars, SUVs, and trucks.”

Leavitt described these measures as part of the administration’s broader effort to improve affordability and stimulate economic growth. She said the initiatives are intended to expand manufacturing, increase consumer choice, and create “good paying jobs” across the country.

The press secretary also characterized President Trump’s recently signed tax and spending package as the “largest” middle-class tax cut in history.

“This is shaping up to be the biggest tax refund season ever, and we are in it now,” she said, noting, “President Trump and Republicans fundamentally believe that Americans deserve to keep more of their hard-earned money, not less, which is why he fought so hard to deliver this long overdue relief.”

She added that measures ranging from eliminating taxes on tips, overtime, and Social Security benefits to allowing auto loan interest deductions on new American-made vehicles, along with increases to the standard deduction and the Child Tax Credit, are expected to put more money back into the pockets of hardworking Americans.

“We’re already hearing from everyday Americans across the country who are reporting substantial tax savings thanks to the working families tax cut, which every single Democrat in Congress voted against,” she said, as she read reactions from individuals describing their experiences.