Indian exporters face heightened uncertainty after the United States slapped a combined 50 per cent tariff on imports from India, making it the most heavily tariffed nation globally and threatening profitability across key sectors, ratings agency ICRA warned.

The U.S. first imposed a 25 per cent reciprocal tariff on Indian goods in July, followed by an additional 25 per cent penalty in late August, citing India’s continued engagement with Russia in oil and defense despite Western sanctions. The move places India at a significant disadvantage compared to Asian peers such as Vietnam, Bangladesh and Japan, which face levies of 15–30 per cent.

“High tariffs have positioned India as one of the most heavily tariffed countries globally, significantly undermining its competitive edge,” ICRA said in its latest cross-sector review.

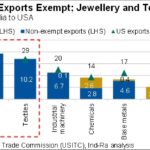

Exports to the U.S. form a substantial share of India’s trade basket, spanning over 140 product categories. Sectors most exposed include auto components (22 per cent of exports going to the U.S.), textiles (25–35 per cent), cut and polished diamonds (37 per cent), seafood (36 per cent) and footwear and leather products (22 per cent).

Channel checks by ICRA show mixed outcomes. Auto component makers reported limited immediate disruption, helped by supply chain stickiness and ability to pass on costs. Metals exporters also managed to transfer tariff hikes to U.S. buyers, who remain reliant on imports.

But textiles, seafood and footwear exporters face sharper pressures. Apparel makers anticipate a 200–300 basis point margin squeeze and revenue declines of 6–9 per cent in FY2026, while shrimp exporters expect similar margin hits as U.S. buyers pivot to lower-tariff suppliers like Ecuador and Vietnam. Footwear and leather shipments are also expected to lose ground to Asian rivals.

The gems and jewelry industry, which polishes 90 per cent of the world’s diamonds, is rerouting shipments through Dubai, Belgium and Israel to circumvent the tariff shock. However, ICRA cautioned that any U.S. move to clamp down on trans-shipment could deepen the pain.

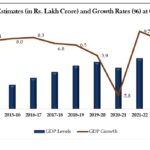

Despite sectoral headwinds, ICRA said India’s GDP growth forecast for FY2026 has been revised back to 6.5 per cent from 6.0 per cent, aided by GST rationalization and strong domestic demand.

“While sectors such as auto components and metals are coping through pass-through strategies, others like textiles, seafood and footwear are more vulnerable. Chemicals face profitability risks if they are forced to absorb costs, and competitive pressure from China remains a concern,” ICRA noted.

![india us tariff clash[1].jpg](https://southasianherald.com/wp-content/uploads/2025/09/india-us-tariff-clash1.jpg-1170x655.jpeg)