India’s $280-billion IT and business-process services sector is staring at a fresh geopolitical shock from Washington, where a new Senate bill threatens to slap steep tax penalties on outsourcing. Industry leaders warn that if the proposal gains traction, it could blunt India’s labor-cost edge and unsettle the world’s largest services-trade corridor.

The Halting International Relocation of Employment (HIRE) Act, introduced as S. 2976 in October by Republican Senator Bernie Moreno of Ohio, seeks to impose a 25% excise tax on payments made by U.S. companies to foreign service providers and block those payments from being claimed as deductible business expenses.

For an industry where over 60% of revenue comes from American clients, the implications are immediate and direct.

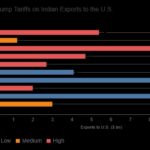

A new analysis by the Global Trade Research Initiative (GTRI) warns the bill could “severely undermine India’s service-export competitiveness,” raising the effective cost of offshore services by 30–50% and eroding the very cost arbitrage that turned India into the world’s outsourcing powerhouse.

A Protectionist Bill with Sharp Edges

The HIRE Act is among the toughest anti-outsourcing proposals to surface in Washington in years.

Although it has no co-sponsors and no scheduled hearings, analysts caution that its provisions are unusually aggressive:

- 25% excise tax on any outsourcing payment benefiting U.S. consumers.

- Non-deductibility rule, lifting total cost penalties close to 46%.

- Broad coverage spanning IT services, software development, customer support, engineering, consulting and even intra-group payments within multinationals.

- Effective date set for payments made after December 31, 2025, if enacted.

Senator Moreno has pitched the bill as a way to “hit companies where it hurts” when they offload domestic jobs to cheaper foreign markets. A September attempt to pass it through unanimous consent was blocked, but the episode exposed the depth of anti-offshoring sentiment within the Trump-aligned flank of the Republican Party.

India: The Largest Target Without Being Named

While the bill makes no explicit mention of India, it would hit no country harder.

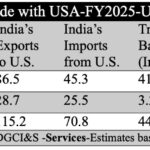

With $250–283 billion in FY25 revenues and a dominant share of U.S.-linked IT, engineering and back-office work, India is the single largest offshore services destination for American companies.

GTRI estimates that more than half of India’s $224-billion services exports are tied to U.S. clients. That makes S. 2976 a potential shock to India’s export earnings, outsourcing-linked employment and strategic positioning in global tech supply chains.

GTRI flags application maintenance, customer support and back-office operations as the most exposed — areas where margins are thin and cost sensitivity is high.

A Potential Flashpoint in U.S.–India Services Trade

Economists say the issue extends beyond outsourcing.

Former RBI governor Raghuram Rajan argues that the bill effectively tariffs digital services, shifting protectionism from goods to cross-border tech flows — a space where India dominates.

Opposition figures like Jairam Ramesh have warned that a punitive tax on India’s biggest export industry could “light a fire under the economy,” especially as global tech spending remains uneven.

GTRI’s report underscores that the HIRE Act signals “a new phase of American protectionism,” and one that could reshape India–U.S. economic engagement for years.

Will the Bill Pass? The Odds Are Low — But Not Dismissible

For now, the legislation faces headwinds:

- No bipartisan support.

- Corporate America, especially tech and finance, expected to push back.

- Narrow Republican Senate majority offers little room for maneuver.

- Tax bills involving cross-border definitions often stall or get diluted.

Still, trade specialists caution against complacency. Even if S. 2976 fails, its structure could reappear in narrower, sector-specific bills or be folded into a broader tax package.

GTRI notes that the idea — taxing, not restricting, offshore services — may prove politically attractive in a protectionist climate.

Indian IT’s Early Playbook: Diversify and De-Risk

Major Indian IT firms have begun hedging:

- Greater market diversification toward Europe, Japan and Australia.

- More onshore U.S. centers to protect strategic accounts.

- Faster migration into high-value digital services — AI engineering, cloud transformation, cybersecurity — where price sensitivity is lower.

- Restructuring GCC financial flows to avoid falling under “outsourcing payments.”

- Diplomatic engagement, with New Delhi seeking clarity from Washington.

Some analysts say several GCCs may continue expanding in India but redesign internal invoicing structures to stay clear of the tax net.

A Warning Sign for the Future of Global Services

The HIRE Act may never become law. But the timing is unsettling.

India’s IT sector is already juggling AI-driven automation, leaner client budgets, and shifting digital rules across Europe and Asia. A new variable from Washington — even a low-probability one — adds another layer of uncertainty.

GTRI’s conclusion is blunt:

“India must prepare for a long-term scenario where the U.S.–India services corridor becomes politically contested.”

The threat remains distant. But the direction of U.S. policy is shifting — and India’s most successful export engine is reading the signs with growing unease.