India’s export engine is bracing for its sharpest external shock in years after Washington imposed an additional 25% tariff on a wide range of Indian-origin goods, raising total duties on many categories to a prohibitive 50% from August 27, 2025.

The Federation of Indian Export Organizations (FIEO) on Tuesday sounded alarm bells, warning that the move could cripple nearly 55% of India’s shipments to its largest trading partner — worth $47–48 billion — by making them 30–35% more expensive than rival products from Vietnam, Bangladesh, China and Mexico.

“This is a severe setback that renders a majority of our exports to the U.S. uncompetitive,” said S C Ralhan, President of FIEO. “Textiles, jewelry, shrimp, carpets, handicrafts and furniture are staring at a collapse. Immediate government support is critical to sustain liquidity and protect jobs.”

$37 Billion Trade Loss Looms

A parallel study by the Global Trade Research Initiative (GTRI) estimates that India could lose up to $36.9 billion in exports — 43% of its $86.5 billion shipments to the U.S. in FY25 — as buyers shift to lower-cost suppliers.

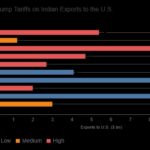

Under the new regime, $60.2 billion worth of Indian goods will face 50% duties, another $3.4 billion will attract 25%, while only $27.6 billion — mainly pharmaceuticals, electronics and refined fuels — remains unaffected.

Pharmaceuticals and APIs, worth $12.7 billion, escape tariffs, but labor-intensive sectors face near-total exclusion from the U.S. market.

Textiles & apparel ($10.8 bn exports): Tariffs rise to 64%, pricing Tirupur, Noida and Surat clusters out of contention. Orders have slowed, with factories already cutting shifts.

Gems & jewelry ($10 bn, 40% U.S. share): Duties climb to 52.1%, hitting Surat’s diamond polishers and Mumbai’s SEEPZ exporters.

Shrimp ($2.4 bn, 32% U.S. share): Tariffs now total 60%, risking supply gluts, farmer distress and processing shutdowns in Andhra Pradesh and Odisha.

Carpets & handicrafts ($2.8 bn): Bhadohi, Mirzapur, Kashmir, Jodhpur and Moradabad risk mass layoffs as U.S. buyers turn to Turkey, Mexico and Vietnam.

Furniture & leather goods ($2 bn+): Jodhpur and Saharanpur units face cancelled contracts, with European and Mexican producers likely to benefit.

Growth Shock Ahead

The GTRI projects that the tariff shock could shave nearly one percentage point off India’s economic growth, slowing GDP expansion to 5.6% in FY26 from a projected 6.5%. While overall exports (goods and services) may still rise modestly to $839.9 billion, thanks to a 10% jump in IT services, the loss of market share in U.S. goods trade risks permanent scarring.

“Once buyers pivot to Vietnam or Mexico, regaining space is extremely difficult,” GTRI co-founder Ajay Srivastava warned.

FIEO’s Emergency Playbook

Ralhan urged the government to immediately roll out a package of relief measures to prevent job losses and bankruptcies in export hubs. His recommendations include:

Credit relief: Interest subvention schemes, export credit support, and low-cost working capital for MSMEs, backed by directives to banks and the Reserve Bank of India.

Debt moratorium: A one-year moratorium on loan repayments, automatic 30% enhancement of credit limits, and collateral-free lending on the lines of ECLGS.

Sectoral push: Expansion of PLI schemes, investments in cold-chain and storage infrastructure, and targeted support for labor-intensive sectors.

Market diversification: Accelerated free trade agreements with the EU, GCC, Africa, and Latin America, with early-harvest deals to offset U.S. losses.

Brand India drive: Global branding, quality certifications, and innovation-focused export promotion to make Indian goods more competitive.

Ralhan stressed that beyond domestic support, urgent diplomatic engagement with Washington was essential. “Negotiating a carve-out or phased relief must be on the table, even as we expand markets elsewhere,” he said.

Limited Cushion

Despite the grim outlook, India’s relatively low dependence on exports — just 20% of GDP, compared to over 90% for Vietnam — offers some insulation. Stronger domestic consumption and services exports may buffer the blow.

Yet for millions employed in labor-intensive industries, the pain will be immediate. “The steps taken now will decide how effectively India withstands this external shock and reasserts its presence in the global export landscape,” FIEO said in a statement.