As high-level US trade officials prepare to descend on India, ostensibly to iron out an interim trade agreement before the July 9, 2025, reciprocal tariff deadline, a new report from the Global Trade Research Initiative (GTRI) is poised to fundamentally disrupt the long-standing American narrative of a trade deficit with India. This isn’t just about statistics; it’s about leverage, and GTRI’s analysis arms India with a potent counter-argument to what it perceives as a one-sided pressure campaign.

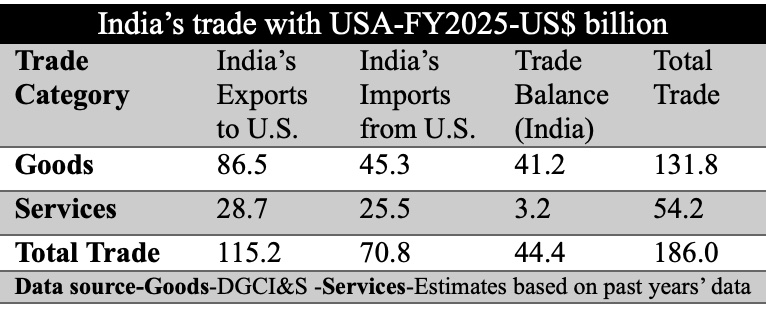

Authored by Ajay Srivastava, the GTRI report, provocatively titled “The Hidden Surplus: How India Fuels U.S. Profits Beyond Trade,” directly refutes the US assertion of a $44.4 billion trade deficit with India in FY2025.

“This trade deficit narrative is misleading — and incomplete,” the report asserts, laying bare the core of its argument. GTRI reveals that the US covertly extracts an astonishing $80–85 billion annually from India through a vast array of services and capital flows that are conveniently omitted from traditional goods trade calculations. These “hidden” earnings span high-value sectors:

- Education: Indian students funnel over $25 billion annually into US higher education, a substantial “export” for America that remains largely unacknowledged in trade balance discussions.

- Digital Dominance: US tech titans like Google, Meta, Amazon, and Microsoft command $15–20 billion annually from India’s burgeoning digital market, a revenue stream often repatriated with minimal local taxation.

- Financial & Consulting Powerhouses: American financial institutions and consulting giants capture $10–15 billion from India’s lucrative financial sector.

- Global Capability Centers (GCCs): US corporations leveraging Indian talent through GCCs generate $15-20 billion in revenue annually, with the economic value predominantly booked in the US.

- Intellectual Property & Licensing: Pharma and auto industries rake in billions through patents, licensing, and technology transfers.

- Cultural & Defense Exports: Hollywood and US streaming platforms add significant sums, alongside the opaque yet substantial defense sales.

When these colossal revenue streams are factored in, GTRI’s meticulous calculations reveal a stark reversal: the US is not running a deficit with India at all. Instead, it enjoys a robust $35–40 billion surplus.

This re-evaluation “flips the script entirely,” as the GTRI report aptly puts it. Far from being a trade victim, the US emerges as a significant net beneficiary of its economic engagement with India. This critical insight provides New Delhi with powerful ammunition as it enters high-stakes negotiations for an interim trade agreement, especially given the impending July 9 deadline for the suspended 26 per cent reciprocal tariff.

The GTRI analysis empowers India to negotiate from a position of strength, effectively dismantling hollow deficit arguments and demanding genuinely fair, balanced, and reciprocal terms. “India can and should negotiate the free trade agreement from a position of strength — rejecting hollow deficit arguments and demanding fair, balanced, and reciprocal terms,” the report concludes.

Furthermore, GTRI issues a sharp warning: if the US persists in its narrow focus on the trade deficit, India should staunchly confine negotiations to reciprocal tariff cuts. It should firmly resist any attempts to broaden the discussion to areas like government procurement, digital trade, or intellectual property – sectors where US firms already enjoy massive and under-recognized profits. Conceding ground in these areas would merely amplify America’s already dominant earnings from the Indian market without addressing the true economic imbalances.

With Commerce and Industry Minister Piyush Goyal having recently engaged with US Commerce Secretary Howard Lutnick, and India’s chief negotiator Rajesh Agrawal concluding Washington talks last week, the stage is set for a pivotal round of discussions.

The GTRI report serves as a timely and potent reminder that in the complex tapestry of international trade, the devil – and the dollars – often lie in the details beyond the official ledger. As both nations aim to more than double bilateral trade to $500 billion by 2030, a clear-eyed and comprehensive understanding of the financial flows will be paramount to forging a truly equitable partnership.

Disclaimer: The opinions and views expressed in this article/column are those of the author(s) and do not necessarily reflect the views or positions of South Asian Herald.