A landmark ruling by the U.S. Court of International Trade striking down most of President Donald Trump’s “Liberation Day” tariffs has upended the dynamics of India-U.S. trade negotiations, just days before senior U.S. trade officials are set to visit New Delhi, India, on June 5–6, 2025.

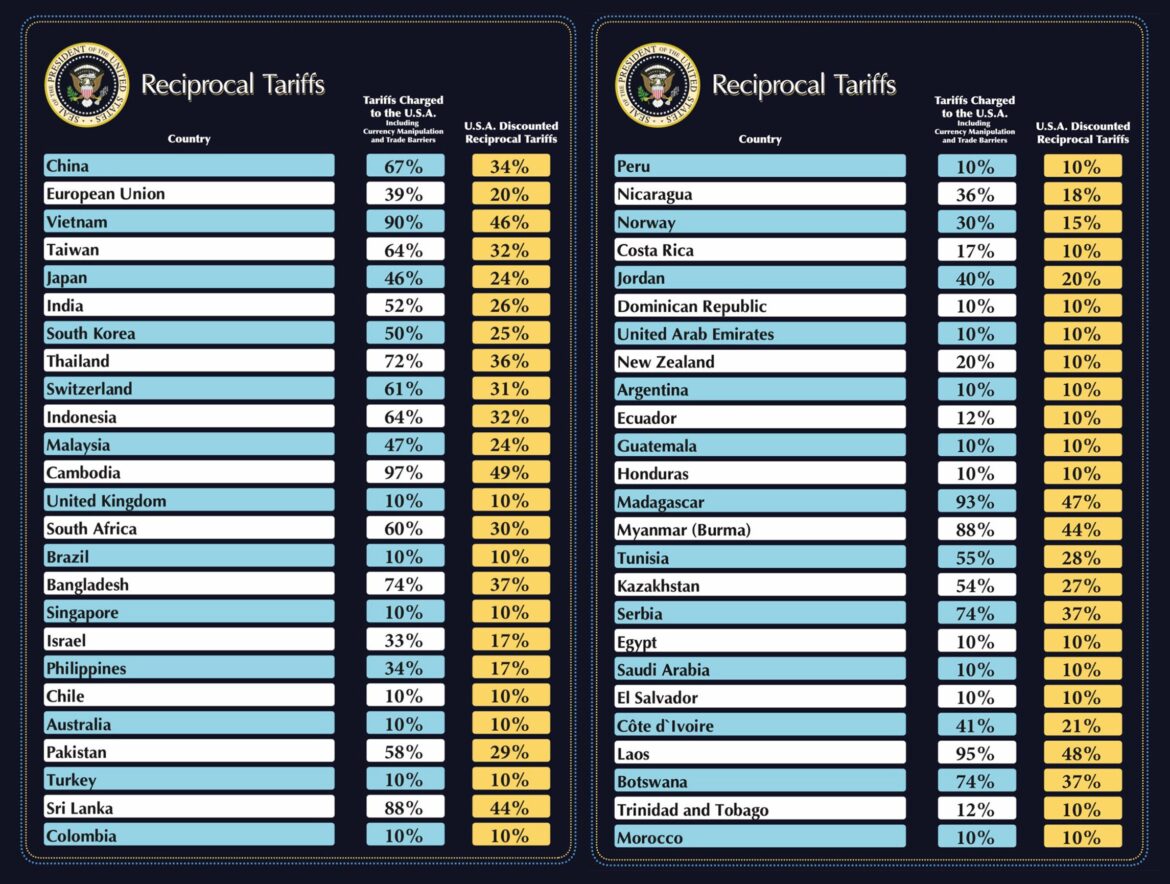

India’s Commerce Ministry is closely studying the implications of the May 29 verdict, which invalidated a 26 per cent reciprocal tariff on Indian imports and could significantly tilt the balance in India’s favor as talks on the Bilateral Trade Agreement (BTA) push toward a July 8 conclusion.

The U.S. court ruled that Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs on grounds of trade deficits was unlawful, effectively stripping the administration of a key legal tool used to justify sweeping duties on trading partners, including India. The decision is widely seen as a major setback for U.S. leverage in the ongoing BTA negotiations.

Court Blow Shifts Negotiating Terrain

Legal and trade experts in India view the ruling as a game-changer. “The ruling removes the primary pressure point the U.S. had in talks,” said Ajay Srivastava, co-founder of the Global Trade Research Initiative (GTRI). “India should now reassess all concessions on the table and seek a legally sound, equitable agreement.”

The judgment could delay or dilute U.S. demands in sectors such as agriculture, digital trade, and government procurement, where India has so far been cautious. With the coercive tariff tool now invalidated, analysts say India can push for more favorable terms, including exclusion clauses for key export sectors like pharmaceuticals, semiconductors, and textiles.

Government sources confirmed that India’s Commerce Ministry has launched a detailed review of the court ruling to assess its full impact on the BTA negotiations. “We are evaluating how this decision changes the legal environment and what room it gives us to renegotiate key terms,” one senior official said, speaking on condition of anonymity.

The ministry is expected to update its negotiation strategy ahead of the U.S. delegation’s arrival next week. The talks are viewed as pivotal to finalizing the first phase of a broader trade pact between the two nations, which have been inching toward closer economic and strategic ties amid global supply chain realignments.

Market Relief, But Analysts Warn of Trump’s Alternatives

Financial markets responded with cautious optimism. Indian benchmark indices—Sensex and Nifty 50—closed 0.34 per cent and 0.29 per cent respectively, as investors welcomed a reduction in trade-related uncertainty. Global stocks also rallied, with Dow futures rising over 500 points on the day of the ruling.

“Trump could still fall back on other legal provisions like Section 232 of the Trade Expansion Act to reimpose duties,” analysts at Goldman Sachs said. They warned that the administration may explore new legal pathways to maintain its protectionist stance, particularly if the court’s decision is overturned on appeal. The Trump administration has already indicated plans to challenge the ruling in the U.S. Court of Appeals for the Federal Circuit and potentially escalate the matter to the Supreme Court.

WTO Alignment and Strategic Leverage

Trade experts said the ruling bolsters India’s case for a WTO-compliant deal. “The BTA must cover substantially all trade to meet WTO norms,” said Prabhash Ranjan, professor of international law. “India must now ensure it does not sign a deal that selectively benefits the U.S. while breaching multilateral principles.”

A contentious “forward most-favored-nation” clause—proposed by the U.S. to secure future tariff parity with other partners—is likely to come under fresh scrutiny. Experts suggest India now has the legal and political space to reject such provisions unless accompanied by reciprocal guarantees.

With strategic cooperation deepening between the two countries in areas like defense, semiconductors, and AI, New Delhi is expected to press for broader economic access while guarding sensitive domestic sectors.

“The court ruling is a shot in the arm for India, but it’s not a free pass,” said Abhijit Das, former head of the Centre for WTO Studies. “Trump may still find ways to weaponize trade laws. India must proceed strategically, ensuring legal robustness while advancing its export interests.”

As the countdown begins for next week’s trade talks, Indian negotiators are likely to use the court ruling as a tactical advantage—while bracing for potential countermoves from Washington. The Commerce Ministry’s review will be central to recalibrating India’s approach, with emphasis now shifting from reactive concessions to assertive bargaining.

The bilateral trade landscape has shifted, but whether it leads to a breakthrough or further legal and diplomatic wrangling will depend on how both sides play the next round of negotiations. For now, India appears to have regained crucial leverage at a decisive moment.