India’s economy, while experiencing a slowdown in its growth trajectory, continues to outpace its Chinese counterpart, according to provisional estimates released by the Ministry of Statistics and Programme Implementation (MoSPI) on Thursday. The data, which comes just ahead of the Reserve Bank of India’s (RBI) crucial monetary policy committee meeting, provides key insights into the nation’s economic health.

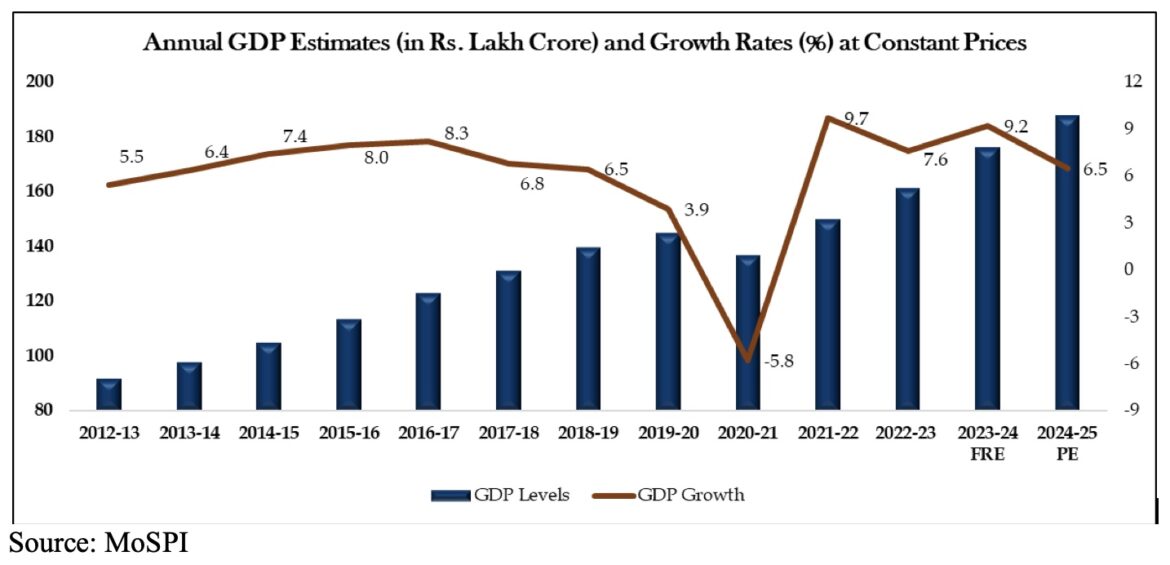

India recorded a real Gross Domestic Product (GDP) growth of 6.5 per cent for the financial year 2024-25 (FY25). Although this marks a moderation from the 9.2 per cent growth seen in the previous fiscal year, it remains significantly higher than China’s 5.4 per cent growth in the first three months of 2025.

For the January-March quarter (Q4 FY25), India’s GDP expanded by 7.4 per cent, exceeding the RBI’s forecast of 7.2 per cent. This quarterly performance was primarily driven by strong gains in construction, public services, financial activities, and a rebound in private consumption.

“India’s Q4 FY2025 YoY GDP growth rose to an enviable 7.4 per cent higher than our above-consensus forecast of 6.9 per cent, and exceeded the real GVA growth of 6.8 per cent, boosted by net indirect taxes,” commented Aditi Nayar, Chief Economist at ICRA Limited. She further noted that “the full year GDP growth printed in line with the second advance estimate of 6.5 per cent.”

The provisional estimates indicate a full-year real GDP of ₹187.97 lakh crore, compared to ₹176.51 lakh crore in FY24. Nominal GDP for FY25 is projected at ₹330.68 lakh crore, a 9.8 per cent increase over the previous year.

Gross Value Added (GVA) at constant prices, a measure excluding taxes and subsidies, grew by 6.4 per cent in FY25, and by 6.8 per cent in Q4. Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank, observed, “The GVA estimate, however, remains more tepid at 6.8 per cent. Expectedly, the high net indirect tax growth has led to the wide gap between the two.”

Analysts are closely watching these figures as the RBI prepares for its upcoming monetary policy review. “The high-frequency data in the last few months continues to point towards a patchy recovery, with the sequential momentum suggesting moderation compared to the previous quarter,” said Bhardwaj. She added, “We expect the benign inflation and soft growth to continue to provide the MPC room for incremental monetary easing, with 25bp cut in the upcoming June policy.”

Chief Economist at Bank of Baroda, Madan Sabnavis, expressed similar sentiments about the RBI’s potential moves. “India’s GDP growth numbers for Q4 and FY25 do display a strong degree of resilience with growth being maintained at 6.5 per cent for the year,” Sabnavis said. “With no change in the growth rate compared with the 2nd advance estimate, we do believe that growth for FY26 will be maintained in the range of 6.4-6.6 per cent.”

Assistant Economist at Capital Economics, Joe Maher, offered a positive outlook, suggesting that lower interest rates and shifts in global trade could further bolster India’s growth. “GDP figures for Q1 2025 show that India’s economy grew at a robust pace at the start of the year and we think that growth may remain strong over the coming quarters as lower interest rates filter through into the economy and Indian exporters benefit from punitive US tariffs on China,” Maher stated. “We expect economic growth to remain strong over the coming quarters, even if it is unlikely to pick up further.”

Looking ahead, the RBI has pegged GDP growth for the ongoing financial year (FY26) at 6.5 per cent. The next set of quarterly GDP estimates, covering April–June 2025 (Q1 FY26), is scheduled for release on August 29, 2025, which will provide further clarity on India’s economic trajectory amidst global uncertainties.