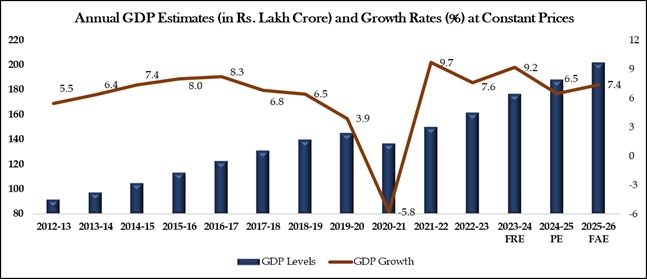

India’s economy is expected to grow 7.4% in the financial year ending March 2026, accelerating from a provisional 6.5% expansion in FY25, government estimates showed on Tuesday, as strong services activity and sustained investment offset weaker farm output and a rising import bill.

The First Advance Estimates released by the National Statistical Office (NSO) place India among the fastest-growing major economies despite persistent global trade uncertainty and uneven external demand.

At constant prices, real gross domestic product (GDP) is projected at ₹201.9 lakh crore in FY26, equivalent to about $2.43 trillion, compared with ₹187.97 lakh crore, or $2.26 trillion, a year earlier. Nominal GDP is estimated to rise 8.0% to ₹357.14 lakh crore, or roughly $4.3 trillion, reflecting easing inflation alongside steady real activity.

Services-led growth

Gross value added (GVA) at basic prices is estimated to grow 7.3% in real terms, with services providing most of the momentum. Financial, real estate and professional services, along with public administration and defense, are projected to expand nearly 10%.

Trade, transport, hotels and communication services are expected to grow 7.5%, supported by resilient domestic travel, logistics demand and steady services exports. Economists said the estimates underline India’s increasingly services-driven growth pattern since the pandemic.

Manufacturing and construction are both projected to grow around 7% in real terms, supported by government-led infrastructure spending and improving corporate balance sheets. Overall industrial growth remains moderate, pointing to a gradual rather than broad-based manufacturing recovery.

Agriculture and allied activities are expected to grow 3.1%, reflecting uneven monsoon outcomes and a normalization after stronger performance in earlier years. Utilities such as electricity, gas and water supply are projected to grow just over 2%.

Demand and trade

On the expenditure side, gross fixed capital formation – a key measure of investment – is projected to rise 7.8% in real terms, translating into nominal investment of roughly $1.4 trillion. Public capital spending remains the main driver, with selective private investment additions.

Private final consumption expenditure, which accounts for more than half of GDP, is estimated to grow 7.0% in real terms, reaching about $2.5 trillion in nominal value. Economists said consumption remains uneven, with urban demand outpacing rural spending.

Exports of goods and services are estimated to grow 6.4% in real terms, while imports are projected to surge 14.4%, driven by capital goods, electronics and energy-related purchases. The faster rise in imports could widen the current account deficit in FY26, analysts said.

Per capita GDP at constant prices is estimated at ₹1,42,119, or about $1,700, up from ₹1,33,501 a year earlier, pointing to steady but modest income gains.

Outlook and revisions

Economists broadly said the 7.4% estimate is in line with expectations, reflecting strong output in the first half of FY26. The Reserve Bank of India has projected 7.3% growth for the year, citing broad-based momentum across services and investment.

The NSO cautioned that the estimates are based on partial data available up to November 2025 and will be revised as more information becomes available. Revised figures, along with updated historical data using a new 2022–23 base year, are due on February 27, 2026.

For now, the projection sets a stable macroeconomic backdrop ahead of the Union Budget, even as policymakers balance growth support with fiscal consolidation.