The Indian government is staring at an increasingly uncomfortable policy gap as exports to the United States contract at a pace not seen in over a decade. Officials are being urged to move faster on stalled export-support schemes and to confront Washington on punitive tariff actions that have wiped out billions of dollars in shipments since May.

Trade experts say New Delhi now faces a two-front challenge: repairing the domestic scaffolding that supports exporters while negotiating a rollback of U.S. duties that have surged to 50% on a wide array of Indian goods. Without these interventions, India risks locking itself into a long-term loss of market share at a moment when supply chains worldwide are shifting.

The government’s own Export Promotion Mission—announced in March and approved by the Cabinet on November 12—sits at the heart of the problem. Eight months into the fiscal year, it remains a blueprint without operational guidelines. Long-running programs such as the Market Access Initiative and the Interest Equalization Scheme, which many small and medium exporters depend on for liquidity and marketing support, have not released any payments this year. With combined funding of under ₹4,200 crore, exporters warn the Mission will fall far short of its stated ambition unless the finance and commerce ministries move quickly to restore disbursals, set clear eligibility norms and roll out the promised incentives.

The diplomatic track looks just as important. India has yet to secure the withdrawal of an additional 25% U.S. tariff linked to its past purchases of Russian oil. New Delhi argues that the original trigger for the levy no longer holds—President Trump himself has said India has “very substantially” reduced dealings with sanctioned Russian firms. Rolling back this extra duty would reduce the effective tariff burden on many Indian goods to 25%, giving labor-intensive sectors such as textiles, gems and jewelry and leather a measure of breathing space.

Unless these steps come together soon, India will continue to bleed market share, as recent trade data makes painfully clear.

Tariffs Push Indian Exports into a Five-Month Freefall

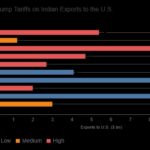

Between May and October 2025, India’s shipments to the United States fell 28.5%, sliding from USD 8.83 billion to USD 6.31 billion. The trigger was a rapid series of U.S. tariff hikes—10% in April, 25% in early August and 50% by late August—that left Indian exporters suddenly among the most heavily taxed suppliers to the American market. China faced peak tariffs of around 30%, Japan only 15%.

The collapse cut across all tariff categories, including products that were supposedly shielded from the duties.

Even tariff-exempt items—smartphones, pharmaceuticals and refined petroleum—fell 25.8% to USD 2.54 billion. Smartphones, India’s largest single export line to the U.S., dropped 36% as orders slowed and inventories piled up. Oil-product shipments fell 15.5%, and gasoline exports fell to zero by October.

Products facing “uniform” U.S. tariffs across all countries—iron and steel, aluminum, copper and auto parts—also shrank as the American industrial cycle weakened. Aluminum exports plunged 43%. Auto parts slid 22%. These declines underline that Indian exporters are being hit by both policy and macroeconomic headwinds.

Sectors Facing the 50% Tariff Take the Hardest Blow

But the real damage lies in the labor-intensive sectors placed under the 50% duty—categories that accounted for just over half of India’s shipments to the U.S. in October.

Textiles and garments fell almost one-third. Garment exports alone crashed by over 40%, sending tremors through manufacturing hubs in Tirupur, Noida, Panipat and Ludhiana. Orders are being diverted to Bangladesh, Vietnam and Mexico, all of which face significantly lower tariff barriers.

Solar-panel shipments collapsed 76%, wiping out market share that India had painstakingly built over the past five years. China and Vietnam, which face lower tariff rates, have quickly filled the gap, raising the risk that India’s renewable-manufacturing ambitions will be undermined.

Chemical exports slid 38%, hurting clusters in Vapi, Dahej, Ankleshwar and Visakhapatnam. Agro-chemicals fell 41%, essential oils 27%. Gems and jewelry exports dropped 27%, including a 29% fall in cut and polished diamonds. Lab-grown jewelry grew modestly, but raw lab-grown diamonds crashed nearly 80%.

Food and farm shipments—highly sensitive to tariff swings—fell a staggering 45%. Cocoa exports were almost wiped out. Dairy and honey shipments fell 72%. Oilseeds dropped 56%, while spices, tea and coffee declined 37%. From Maharashtra to Kerala and Karnataka, exporters are reporting cancelled consignments and rising stocks with no buyers.

Marine exports, especially vannamei shrimp, tumbled 39%. U.S. buyers are moving to Ecuador and Vietnam, dealing a blow to coastal processing hubs from Nellore to Veraval.

A Shrinking Window for Correction

Trade strategists warn that the longer tariffs remain at these punitive levels, the harder it will be for India to regain lost ground. Supply chains tend to “lock in” once buyers shift permanently to alternate suppliers.

That is why GTRI’s recommendations carry a clear urgency: operationalize the Export Promotion Mission without further delay; restore all paused disbursals; and press Washington for a tariff rollback before entering any new trade negotiations. Without these steps, India’s exporters will continue fighting an unequal battle in their most important foreign market—and losing both orders and jobs in the process.