India’s exports to the United States are poised to shrink by nearly 30 percent this fiscal year following the imposition of sweeping 25 percent tariffs, marking a potential blow to the country’s trade prospects with its largest commercial partner. That’s the stark warning issued Monday by the Global Trade Research Initiative (GTRI), which paints a grim picture of lost competitiveness, export erosion, and rising global headwinds.

The think tank’s report forecasts India’s exports to the U.S. plunging from $86.5 billion in FY25 to just $60.6 billion in FY26, undercut by country-specific tariffs and unspecified penalties that have blindsided Indian exporters. The decline, it argues, is not simply a matter of pricing, but of structural disadvantage, with competitors like Vietnam, Bangladesh, and Mexico escaping similar punitive measures and instead gaining market share.

Sectoral Carnage: Labor-Intensive Industries on the Line

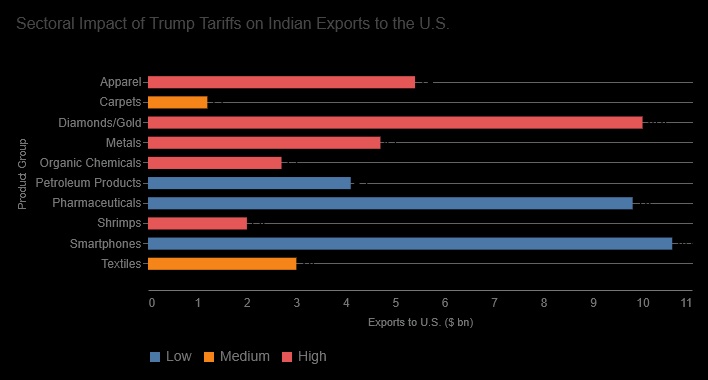

The GTRI analysis points to a disproportionate impact on labor-intensive sectors—precisely those that underpin employment and rural incomes in India. The worst-hit include:

- Garments & Textiles: With knitted and woven apparel exports each worth $2.7 billion, new effective tariff rates of 38.9 percent and 35.3 percent now put Indian producers at a pricing disadvantage. Competing nations like Vietnam and Bangladesh, enjoying preferential access, are expected to benefit from diverted U.S. orders.

- Made-up Textiles: Items like towels and bed sheets now attract 34 percent tariffs, threatening India’s market share in a segment increasingly dominated by Pakistan and Southeast Asia.

- Seafood: India’s shrimp exports—worth $2 billion and supplying a third of the U.S. market—are now subject to a flat 25 percent duty. That may neutralize India’s cost edge over Canada and Chile, both of which benefit from U.S. trade deals.

- Jewelry: The country’s $10 billion jewelry exports to the U.S.—which constitute 40 percent of its global trade—now face 27.1 percent duties. Especially at risk is the $3.6 billion mechanical gold jewelry segment, where margins are too thin to absorb the new tariff shock.

- Engineering Goods and Metals: A broad swathe of industrial exports, including auto components, machinery, steel, and aluminum, will see tariffs upwards of 26 percent, sharply tilting the playing field in favor of Mexico, Japan, and other FTA partners.

Export Diversification Not a Quick Fix

GTRI’s report goes beyond the tariff mathematics to issue a broader critique of India’s overdependence on a few markets. With non-tariff barriers rising across the West—from the EU’s upcoming carbon border tax to its anti-deforestation regulations—the possibility of substituting U.S. losses by pivoting to other markets is described as “increasingly illusory.”

Policy Gaps and Urgent Correctives

To arrest the slide and rebuild resilience, GTRI recommends a five-pronged policy realignment:

- Revive Export Credit Support: Reintroduce the Interest Equalization Scheme with an annual ₹15,000 crore allocation to ease MSME exporters’ access to credit.

- Real-Time Regulatory Helpdesk: Launch a 24/7 digital and voice-based information platform to keep exporters updated on evolving tariffs and compliance requirements.

- FTAs with Realism: Finalize pending agreements with the UK and EU but manage expectations—GTRI cautions that marginal tariff relief alone won’t unlock significant gains without structural reforms.

- Reframe Tourism as Export: Position inbound tourism as an economic export sector by fixing bottlenecks like high hotel taxes, poor visitor experience, and predatory pricing.

- Widen Exporter Base: Roll out a National Trade Network to onboard over 200,000 new firms, digitize compliance, and integrate more SMEs into global supply chains.

Trouble on the Horizon

While some key export categories—notably pharmaceuticals and smartphones—are currently shielded from the new tariffs, GTRI warns this exemption may be short-lived. U.S. policymakers have already floated plans to scrutinize Indian drug exports and impose penalties on electronics that contain Chinese-origin components.

Even a bilateral trade agreement, the report concludes, may offer only temporary reprieve. Without a decisive shift in trade strategy and export ecosystem reform, India risks being caught in the crossfire of escalating global protectionism—a war it may be ill-prepared to fight.