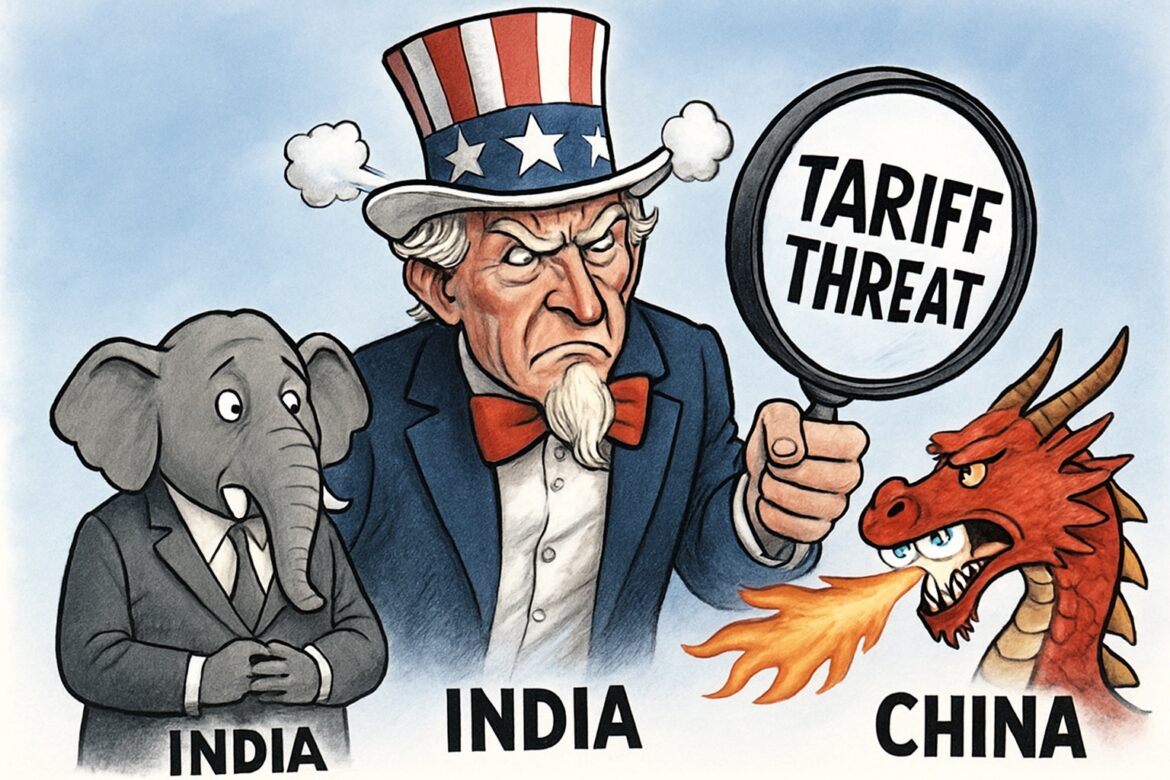

The Trump administration’s announcement of sweeping new tariffs on Indian goods has sent tremors through India’s trade and diplomatic circles, raising urgent questions about the durability of the India-U.S. strategic partnership. On August 6, 2025, Washington declared an additional 25 percent duty on all Indian imports, effective August 27 — doubling the total tariff burden to 50 percent and placing India among the most heavily taxed U.S. trading partners in the world.

The official justification: New Delhi’s continued purchase of discounted Russian crude. But in India, the announcement is being seen less as a protest against oil flows and more as a coercive signal — one that could fundamentally reshape India’s economic engagement with the United States and recalibrate its global alliances.

The new tariffs threaten nearly all of India’s $86.5 billion in annual exports to the U.S. — spanning garments, textiles, machinery, pharmaceuticals, and electronics. According to the Global Trade Research Initiative (GTRI), the move could slash India’s U.S.-bound exports by as much as 40–50 percent in the months ahead.

“These punitive tariffs will price Indian goods out of the U.S. market,” GTRI warned in a briefing. “The consequences for Indian manufacturers, especially in labor-intensive sectors like textiles and auto components, could be devastating.”

Exporters are already bracing for mass order cancellations ahead of the holiday season. The hit to MSMEs — which form the backbone of India’s export engine — is expected to be particularly severe, with ripple effects on jobs and state-level economies.

Washington’s Selective Outrage

What has most angered Indian policymakers, however, is the perceived double standard. In 2024, China imported $62.6 billion worth of Russian oil — far more than India’s $52.7 billion — yet faces no such punitive tariffs. The European Union, a close U.S. ally, imported $39.1 billion in Russian goods last year, including $25.2 billion of oil. Even the U.S. itself bought $3.3 billion in strategic Russian materials, primarily for its defense and tech sectors.

“Washington is picking its targets not based on principle, but on leverage,” said a senior Indian official. “It won’t touch China because of its control over critical materials. It won’t touch the EU due to NATO ties. India, seen as strategically committed but economically dispensable, is the easiest to punish.”

The result, many in New Delhi argue, is a tariff regime driven less by rules and more by realpolitik. “This is not about oil,” said a former Indian ambassador to Washington. “It’s about control. The message is: align fully or be penalized.”

India’s decision to continue buying Russian oil has been rooted in economics, not ideology. Russian crude, discounted well below Brent prices, has helped India manage its import bill and control inflation. Abandoning those purchases — especially under external pressure — would raise fuel prices, widen the fiscal deficit, and weaken economic recovery.

But more than the economic cost, the political danger lies in the precedent. “If we buckle under U.S. pressure on oil today, what stops the Trump administration from targeting our pharma exports tomorrow, or imposing digital taxes?” asked a former commerce secretary.

India has long prized its doctrine of strategic autonomy — cooperating with major powers without becoming beholden to any single one. The tariff decision challenges that posture, putting India in the uncomfortable position of being treated less like a partner and more like a defiant subordinate.

For now, New Delhi is avoiding retaliation. GTRI recommends India maintain composure for six months, avoid reciprocal tariffs, and use the window to both diplomatically engage and diversify export markets.

“Retaliation could escalate tensions and hurt India more than it hurts the U.S.,” the GTRI brief said. “The smarter move is to absorb the shock, strengthen trade with ASEAN, Africa, and the Middle East, and prepare for a future where trade coercion may become more frequent.”

This strategy is already visible in India’s deeper trade outreach through BRICS, increased engagement with Latin America, and growing energy partnerships with Iran and the UAE.

Modi-Trump Diplomacy Under Strain

Perhaps the most jarring element of this dispute is its political symbolism. The tariffs come not from a rival or adversary, but from an administration with which Prime Minister Narendra Modi had invested heavily in personal diplomacy. From the “Howdy Modi” rally in Houston to “Namaste Trump” in Ahmedabad, the Modi-Trump partnership was projected as a new chapter in Indo-U.S. closeness.

Today, those photo-ops appear hollow.

“The very administration that celebrated Indian democracy on U.S. soil is now kneecapping its economy over energy choices,” noted a Delhi-based political commentator. “It’s a betrayal of trust — and a reminder that personality-driven diplomacy has limits.”

The irony will not be lost on domestic audiences. Modi’s critics will likely seize on the tariffs as evidence that his foreign policy — dominated by optics and personal bonhomie — has failed to yield lasting benefits.

The tariff shock may ultimately accelerate India’s ongoing diversification away from Western dependency. New Delhi has already signaled interest in greater BRICS cooperation, particularly on financial mechanisms that bypass the U.S. dollar. There is growing convergence with Russia, Iran, and even China on multilateral platforms challenging Western economic dominance.

“This could be the inflection point where India stops seeking entry into elite Western clubs and starts building alternative ecosystems,” said a senior policy advisor involved in India’s foreign trade strategy. “We’ve learned the hard way that alignment doesn’t mean protection.”

India is also expected to fast-track trade talks with ASEAN, the Eurasian Economic Union, and African regional blocs. Exporters, meanwhile, are urging the government to speed up production incentives, logistics upgrades, and rupee-based trade mechanisms.

WTO Paralysis and Political Risk

India has no recourse through the World Trade Organization, whose appellate body remains defunct. Bilateral negotiations with Washington are now hostage to a tariff-first policy environment, and New Delhi is unlikely to pursue talks under duress.

There may also be domestic political fallout for the Trump administration. Indian American voters — a politically active demographic in swing states like Michigan, Pennsylvania, and Georgia — may not take kindly to a policy that economically penalizes India. With the 2026 U.S. midterms approaching, this miscalculation could cost the Republicans crucial support among diaspora communities.

At its core, the Trump administration’s tariff strike is a reminder of India’s vulnerability in an increasingly transactional world order. A country striving to become a global manufacturing hub cannot afford to rely excessively on any single market — especially one prone to arbitrary economic penalties.

India must now do more than just weather this storm. It must see this moment for what it is: a structural rupture in assumptions about the West, about trade as a neutral domain, and about strategic partnerships as safe bets. What India chooses next — recalibration, diversification, or deeper strategic autonomy — will define not just its trade policy, but its global posture for years to come