Bangladesh’s national budget for fiscal year 2025-26, unveiled on Wednesday by Finance Adviser Dr. Salehuddin Ahmed, outlines a Tk 790,000 crore (approximately $66 billion) spending plan designed to stabilize an economy facing high inflation, fiscal stress, and persistent political uncertainty.

The new budget marks a marginal reduction from the previous year’s Tk 797,000 crore ($66.5 billion), though it reflects a 4.6 per cent increase from the revised outlay of Tk 755,000 crore ($63 billion) for FY2024-25. With a GDP growth target of 5.5 per cent—modestly above World Bank and IMF forecasts—the budget attempts to balance fiscal prudence with development imperatives in a constrained macroeconomic environment.

The government has pegged the GDP growth target at 5.5 per cent, with a projected nominal GDP of Tk 62.4 trillion ($567 billion), up from Tk 55.5 trillion ($505 billion) in FY2024-25. While the target suggests optimism, multilateral agencies remain cautious, projecting sub-5 per cent growth due to tightening global conditions and internal disruptions.

The inflation target has been set at 6.5 per cent, down from a decade-high 10.87 per cent in September 2024 and 9.72 per cent in October. The government is banking on tax and tariff adjustments, import duty rationalization, and subsidy control to ease cost-of-living pressures.

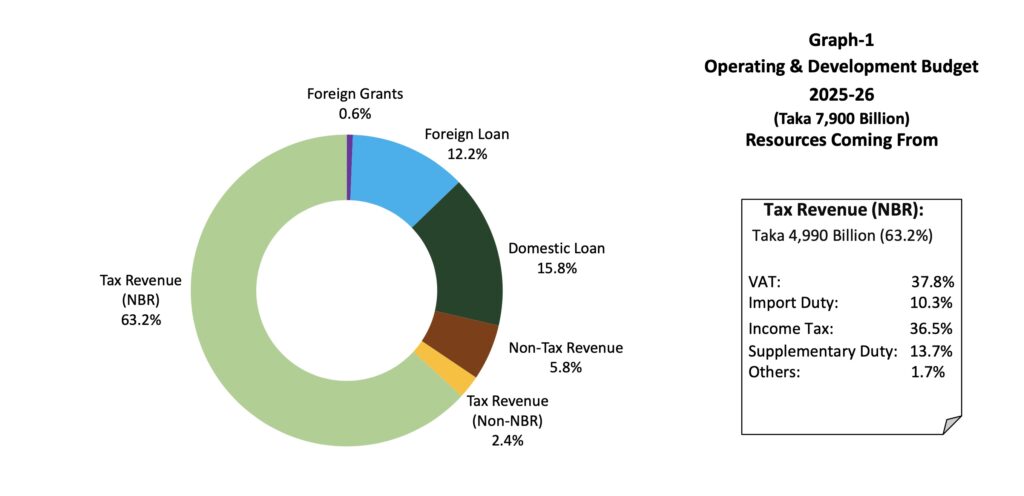

On the revenue side, the budget projects a total intake of Tk 552,000 crore ($49.7 billion). Tax revenues are expected to contribute Tk 500,000 crore ($45 billion), of which the National Board of Revenue (NBR) is responsible for Tk 450,000 crore ($40.9 billion). Non-tax revenues are set at Tk 52,000 crore ($4.7 billion). Analysts warn that the NBR target may be overly ambitious, given historical shortfalls and limited administrative capacity.

Budget Deficit and Financing Strategy

The budget estimates a fiscal deficit of Tk 238,000 crore ($21.6 billion), amounting to 4.6 per cent of GDP. To bridge the gap, the government plans to borrow Tk 140,800 crore ($12.8 billion) from domestic sources, primarily through the banking system, and Tk 97,200 crore ($8.8 billion) from foreign loans and grants.

The high reliance on domestic borrowing—particularly from banks—raises concerns about crowding out private sector credit and pressuring liquidity. Interest payments alone account for Tk 122,000 crore ($11 billion), highlighting the mounting cost of public debt.

Spending Priorities and Sectoral Allocations

Of the total outlay, operating expenditure is projected at Tk 498,200 crore ($44.8 billion), while development expenditure is allocated Tk 277,000 crore ($24.9 billion). The Annual Development Programme (ADP), a cornerstone of public investment, will receive Tk 260,000 crore ($23.4 billion).

Key allocations include:

- Social Safety Nets: Tk 126,000 crore ($11.3 billion), including Tk 4,000 crore ($360 million) for elderly allowances and new pension schemes for low-income earners.

- Education: Tk 94,700 crore ($8.5 billion)

- Health: Tk 41,400 crore ($3.7 billion)

- Energy and Power: Tk 34,000 crore ($3.1 billion) in subsidies, with a focus on boosting renewables and containing rising costs

- Agriculture and Rural Development: Tk 39,000 crore ($3.5 billion)

- Transport and Communication: Tk 74,000 crore ($6.6 billion)

While social spending has expanded in nominal terms, many analysts argue the real allocations remain inadequate in the face of inflation, growing population needs, and infrastructure deficits.

Taxation and Fiscal Reforms

The tax regime introduces a minimum income tax of Tk 3,000–5,000 ($27–45) for regular taxpayers, while retaining existing thresholds for tax-free income and wealth surcharges.

Key VAT reforms include:

- Construction materials: VAT increased from 7.5 per cent to 15 per cent

- Online sales commissions: VAT raised from 5 per cent to 15 per cent

- Export competitiveness: VAT exemptions granted on 110 items, including 98 at the production stage

Customs reforms involve the removal or reduction of supplementary duties on 622 products, and continued exemptions for importing capital machinery and raw materials to aid export-oriented industries. While these measures aim to streamline tax policy and broaden the base, business leaders have raised concerns that increased VAT may inflate operational costs, offsetting gains from duty reliefs and exemptions.

Foreign Exchange and IMF Commitments

Foreign exchange reserves stood at $20.5 billion as of May 2025, buoyed by $25 billion in remittance inflows and 17.7 per cent export growth in December 2024. However, the sustainability of reserves depends on external financing and trade resilience.

Bangladesh is under pressure to meet conditions tied to the IMF’s $4.7 billion loan program. These include deficit reduction, targeted subsidy reforms, and improving tax-to-GDP ratio—currently hovering around 8 per cent, one of the lowest in South Asia. Failure to meet these targets could delay disbursement of the next tranche, complicating fiscal planning and investor confidence.

Implementation Risks and Political Backdrop

The budget has been crafted under an interim government formed after the July–August 2024 political upheaval. With weak institutional capacity and a lack of parliamentary oversight, implementation risks loom large.

“Bangladesh ranks low on global budget transparency indices,” said Prof. Mohammad Abu Eusuf of Dhaka University, referring to the country’s 37th rank in the Open Budget Index. He stressed the need for enhanced public scrutiny and participatory planning.

Energy analysts, such as Shafiqul Alam of IEEFA, have welcomed the focus on renewable energy but warned that without strategic investment and private participation, subsidy burdens will persist. Trade experts have also flagged geopolitical tensions. Former finance adviser AB Mirza Azizul Islam cautioned against retaliatory trade measures with India, urging diplomacy to maintain market access.

The FY2025-26 budget is, at its core, an exercise in balancing ambition with pragmatism. It reflects the government’s attempt to keep growth on track, rein in inflation, and meet external financing conditions without derailing social welfare or development priorities.

But its success hinges on the government’s ability to mobilize revenue, control spending, and implement structural reforms amid a volatile political landscape. As one analyst put it, “The budget looks good on paper. The challenge is turning numbers into outcomes.”

(Note: All USD equivalents are approximate, assuming an exchange rate of Tk 120 per US dollar.)

![salehuddin[1].jpg](https://southasianherald.com/wp-content/uploads/2025/06/salehuddin1.jpg.jpeg)