The International Monetary Fund (IMF) has revised India’s growth forecast to 6.2 percent for 2025, and 6.3 percent for 2026, down from a projected 6.5 percent in 2024.

“The revisions are smaller than for other countries, as India is less exposed to the trade shock,” said Director of the IMF’s Asia and Pacific Department, Krishna Srinivasan, at a press conference held on April 24, 2025, during the IMF and World Bank Spring Meetings in Washington D.C.

Srinivasan attributed the trade shock to “the flurry of tariff announcements by the United States” earlier this year, which significantly impacted the global economy and the Asia Pacific region. In response, the IMF has downgraded its regional and global economic outlooks.

In India, according to him, growth during late 2024 was supported by a rebound in exports and consumption.

“However, the overall outturn surprised slightly to the downside, reflecting a slow start to public investment post elections and temporary factors. Private investment, however, remained weak,” Srinivasan explained. “In other emerging markets, the recovery generally held up with a shift from consumption to investment, in many cases.”

Responding to a question from South Asian Herald about India’s downgraded outlook, Deputy Director of the IMF’s Asia and Pacific Department, Thomas Helbling, said the primary reason mirrors that of the broader region – higher U.S. tariffs.

He pointed out that the United States imposed a universal 10 percent tariff, increasing trade uncertainty. “While India is relatively less open than other countries in the region, it still trades significantly and particularly also with the U.S. The U.S. is a large trading partner so that affects the near-term outlook,” he said.

Helbling reiterated a long-standing IMF view that India stands to benefit from opening its economy further through structural reforms. In the near term, he emphasized the need for labor market reforms to improve labor mobility and support sectors with stronger growth potential.

For the longer term, he recommended enhancing education and investing in public infrastructure to expand trade opportunities and deepen India’s integration both regionally and globally.

Srinivasan highlighted private investment as a key concern for India. “Private investment still remains quite lackadaisical. In fact, as a share of GDP, it’s not too bad compared to here. But if you look at investment in machinery and equipment, things which can increase the productivity of the economy, that’s pretty muted,” he noted.

He referenced work by IMF economists Harald Finger and Christian Henn, who have examined strategies to stimulate private investment.

“So, if India has to reach its target of being an advanced country by 2047, the Viksit Bharat [Developed India] goal, then private investment needs to really pick up momentum. And that is where a lot of reforms are needed,” Srinivasan added.

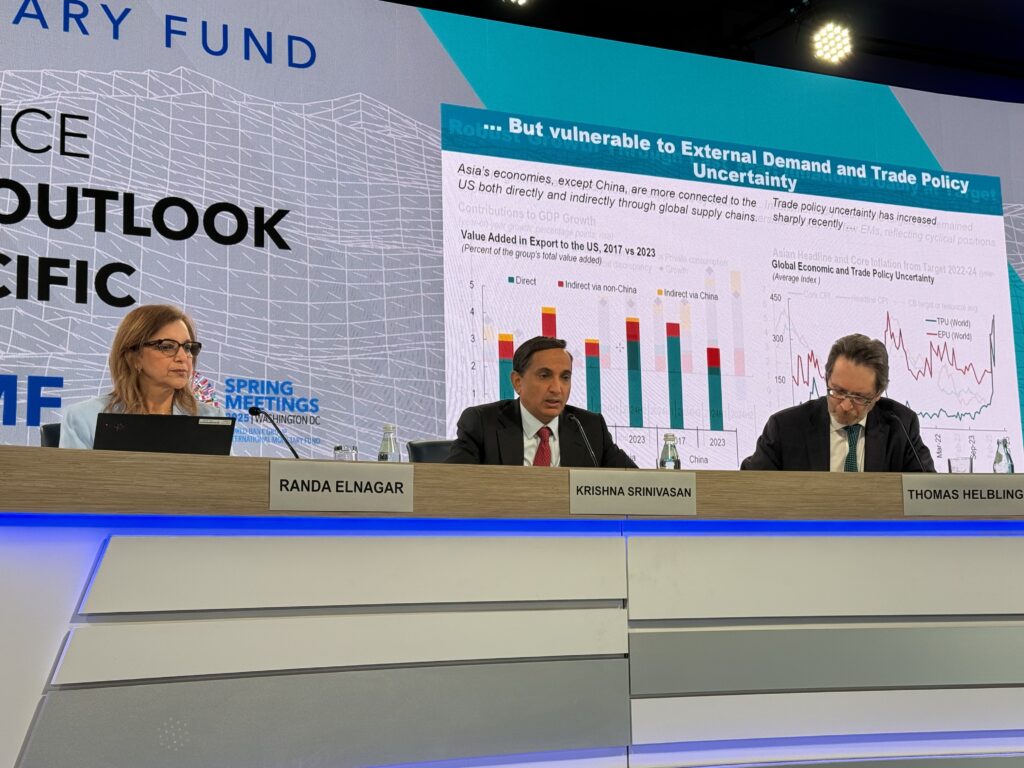

He also outlined three factors that make Asia especially vulnerable to trade shocks and policy uncertainty:

- The region’s strong orientation toward trade and goods;

- A robust export recovery following an earlier reopening from the pandemic compared to other regions;

- Increasing integration into global supply chains, with growing dependence on U.S. demand.

Reflecting on the tariff package announced by the United States on April 2nd, Srinivasan noted that the Asia Pacific region would have experienced the sharpest rise in effective tariff rates globally. Although some measures have since been paused, trade tensions, especially between the U.S. and China, have escalated, contributing to a heightened sense of “uncertainty.”

To mitigate these challenges, Srinivasan called for bold and sustained structural reforms to boost productivity and support medium-term growth.

“The Asia Pacific region faces significant structural challenges, including from increasing demographic challenges and productivity growth that has slowed and remains sluggish in recent years, as you can see in the chart on the left-hand side,” he added. “To boost the region’s productivity, priority should be given to improving the efficiency in matching capital, labor, and other resources to firms, thereby facilitating structural transformation and promoting innovation.”