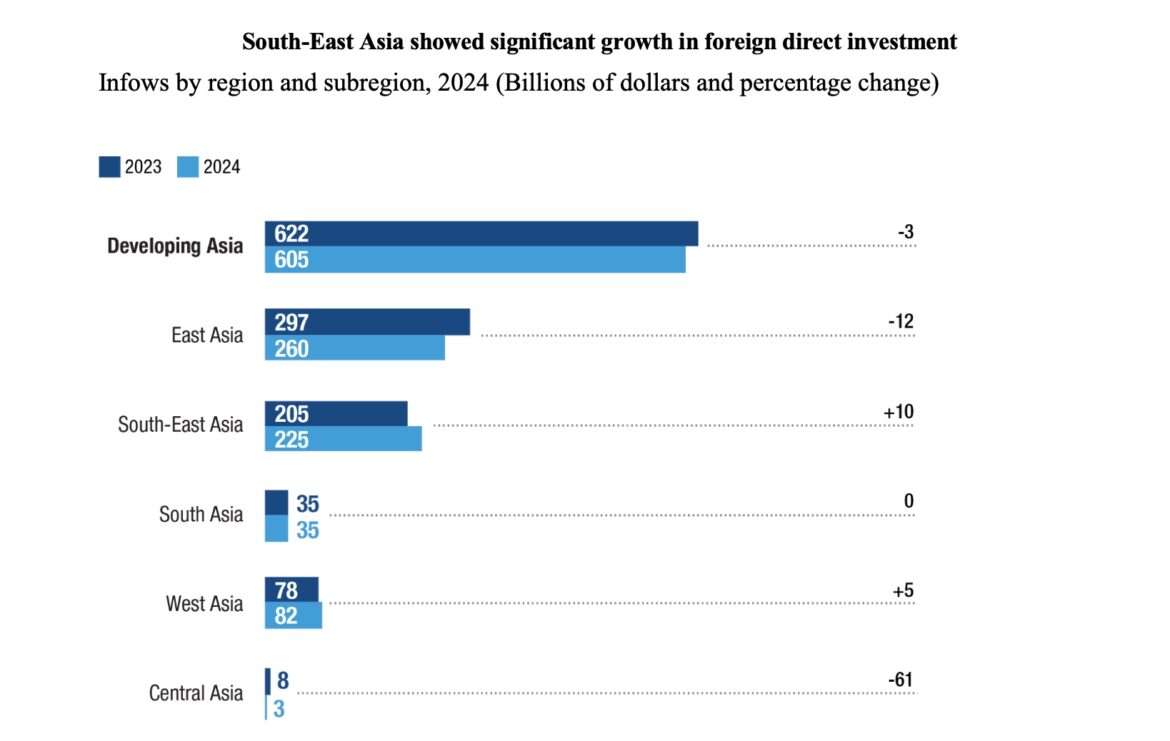

South Asia held firm in the face of a global foreign investment downturn in 2024, even as the United Nations Conference on Trade and Development (UNCTAD) raised red flags over declining capital flows to sectors critical for sustainable development. According to the World Investment Report 2025, developing Asia remained the top global destination for foreign direct investment (FDI), attracting $605 billion — accounting for 40 percent of global FDI and 70 percent of inflows to developing economies.

But the broader picture shows an investment landscape under stress, with total FDI into developing Asia falling 3 percent year-on-year. The report warns that while headline resilience masks deeper structural challenges, many developing countries — especially in the Global South — are increasingly sidelined in the global capital race.

South Asia: A Beacon of Stability

Amid this turbulence, South Asia showed a relatively stable FDI performance in 2024. Pakistan and Sri Lanka posted modest gains, while India — the region’s largest economy — saw a marginal dip in total inflows but remained the subcontinent’s leading FDI destination.

India stood out for its surge in greenfield investment commitments, with announced capital expenditure rising 28 percent to $110 billion. This performance helped cushion the blow from a 23 percent region-wide decline in the value of greenfield investments. India’s strength came from strong investor interest in semiconductors, software development, and electronics manufacturing, reflecting the country’s growing profile in global value chains and digital transformation.

“India continues to demonstrate resilience in attracting long-term capital, thanks to structural reforms, a thriving services sector, and a maturing startup ecosystem,” the report noted.

Southeast Asia Rises; China Stumbles

The ASEAN bloc emerged as a bright spot, with FDI inflows jumping 10 percent to $225 billion — the second-highest level ever recorded. Indonesia, Malaysia, Singapore, Thailand, and Vietnam led the surge, buoyed by supply chain diversification and investment in digital infrastructure.

By contrast, China — traditionally the top FDI magnet in the developing world — saw inflows fall 29 percent, hit by slowing domestic growth, regulatory tightening in the tech sector, and investor uncertainty. Cross-border mergers and acquisitions (M&A) across developing Asia plunged 57 percent, largely driven by China’s decline and significant divestments in India and the UAE.

Infrastructure Investment Collapses

While greenfield investments in digital sectors and metal processing held up, UNCTAD warned of a steep drop in international project finance — particularly for infrastructure. Across developing Asia, the number of project finance deals fell 27 percent, but the total value collapsed by 43 percent.

The report flagged a 30 percent+ decline in FDI into sectors critical to the Sustainable Development Goals (SDGs), including Renewable energy (-31 percent); Transport infrastructure (-32 percent); and Water and sanitation (-30 percent).

This retreat threatens to widen the already massive SDG financing gap, now estimated at $4 trillion annually in developing economies.

Digital Growth Uneven, South Asia at Risk of Exclusion

FDI into the digital economy grew by 14 percent globally, led by ICT manufacturing, semiconductors, and digital services. But this growth remains concentrated: ten countries accounted for 80 percent of all new digital projects.

“Many countries in South Asia and Africa remain excluded from the digital investment boom due to inadequate infrastructure, limited skills, and weak regulatory capacity,” the report cautioned. The digital divide, it warned, is fast becoming an investment divide.

A Call for Smarter, Inclusive Capital

UNCTAD urged global policymakers to not just mobilize more investment, but to channel “smarter capital” that is long-term, inclusive, and aligned with sustainable development.

To help developing economies — including those in South Asia — benefit from the digital and clean energy transitions, UNCTAD proposed a seven-point reform agenda: They include: Strengthen governance of data and AI to guide digital strategies; Develop policy toolkits tailored to emerging markets’ digital needs; Advance global rules for digital trade and investment; Build digital infrastructure through partnerships and blended finance; Foster innovation ecosystems via academic and industrial collaboration; Boost digital skills with targeted training and education; and Ensure responsible digital investment aligned with sustainability norms.

Outlook: Optimism With Caveats

As South Asia navigates an uncertain global economic environment, its ability to maintain steady FDI inflows and drive greenfield expansion — especially in digital and tech sectors — offers cautious optimism. But sustaining momentum will require deepening institutional reforms, investing in infrastructure, and bridging digital capability gaps.

“Redirecting capital to where it’s most needed — particularly in emerging regions like South Asia — demands not just reform, but coordination, vision, and resilience,” the report concluded.

With uneven investment trends persisting across regions and sectors, the world’s poorest and most vulnerable economies remain at risk of falling further behind — unless global capital can be harnessed for inclusive, sustainable transformation.