Indian states are set to maintain high levels of social welfare spending this fiscal year, with expenditures projected at roughly 2 per cent of their Gross State Domestic Product (GSDP), or an estimated ₹6.4 lakh crore (approximately $76.8 billion). This trend, while vital for socio-economic development, is expected to exacerbate revenue deficits and could limit states’ capacity for capital outlays, according to a CRISIL Ratings press release.

The 18 largest Indian states, collectively accounting for 90 per cent of the aggregate GSDP, are anticipated to sustain social welfare spending at levels similar to the previous fiscal year. This marks a notable increase from the 1.4-1.6 per cent of GSDP observed between fiscals 2019 and 2024.

Anuj Sethi, Senior Director at CRISIL Ratings, indicated that social welfare expenditure in fiscals 2025 and 2026 is estimated to rise by approximately ₹2.3 lakh crore (approximately $27.6 billion) from fiscal 2024 levels. Around ₹1 lakh crore (approximately $12 billion) of this increase is earmarked for direct benefit transfers (DBT), primarily to women, often as commitments related to upcoming elections. The remaining ₹1.3 lakh crore (approximately $15.6 billion) is largely for financial and medical assistance to backward classes and social security pensions for specific focus groups, supporting essential socio-economic development.

The surge in social welfare expenses is not uniform, with about 50 per cent of the analyzed states anticipating a significant increase, while others expect stable or modest growth.

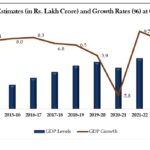

The fiscal implications are substantial, as overall revenue expenditure is budgeted to grow at a compound annual growth rate (CAGR) of 13-14 per cent between fiscals 2025 and 2026. In contrast, revenue receipts grew by a slower ~6.6 per cent year-on-year last fiscal and are projected to increase by only 6-8% year-on-year this fiscal. This widening disparity is expected to keep revenue deficits elevated.

Aditya Jhaver, Director at CRISIL Ratings, warned that an increase in revenue deficit typically compels state governments to reduce capital outlay to maintain fiscal stability. Last fiscal year, capital outlay saw a modest 6% year-on-year growth, a stark contrast to the 11 per cent CAGR over the preceding five years, as the revenue deficit ballooned by almost 90 per cent year-on-year. “If this trend continues this fiscal, it could constrain states’ capital outlay, which has a higher multiplier effect and can stimulate increased investment in the economy,” Jhaver said.

CRISIL Ratings noted that several states that have recently held elections had already introduced new DBT schemes or increased allocations to existing ones. With upcoming elections in other states, a further rise in DBT as part of election commitments remains a key factor to monitor.

While acknowledging the critical role of social welfare spending in development, CRISIL Ratings emphasized that an increase in such allocations without a corresponding rise in revenue receipts could negatively impact states’ credit profiles in the long run, underscoring the importance of fiscal prudence.

Conversion Rate Used: 1 USD = 83.3 INR (Approximate conversion rate as of June 26, 2025)