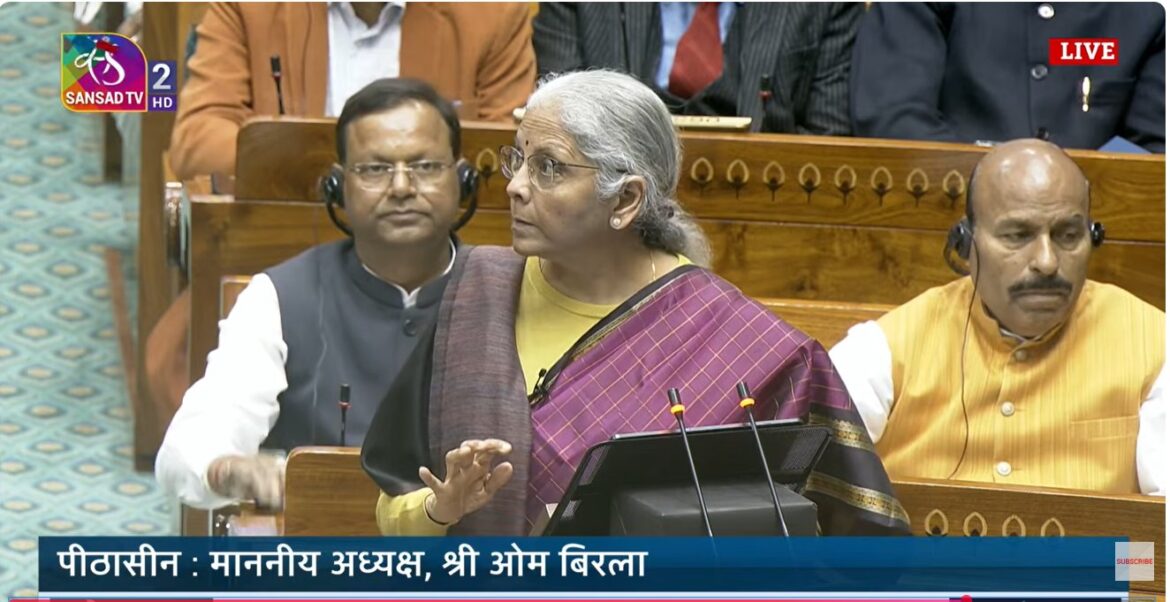

New Delhi – In a move to strengthen the bridge between India and its 32-million-strong global diaspora, Finance Minister Nirmala Sitharaman’s 2026-27 Union Budget has introduced a sweep of “common sense” reforms.

From slashing the costs of sending money home for a child’s education to simplifying how families move back to India, the budget shifts the focus from rigid regulation to a “trust-based” relationship with Non-Resident Indians (NRIs).

For the Indian diaspora, often navigating the complexities of two different tax systems, this budget offers a roadmap toward a “frictionless” connection with their homeland.

The ‘Education and Health’ Dividend: Lowering Remittance Costs

One of the most significant pain points for NRIs and Indian families with global ties has been the Tax Collection at Source (TCS) on money sent abroad. Under the Liberalized Remittance Scheme (LRS), families often faced high upfront tax deductions when paying for overseas tuition or medical emergencies.

The 2026 Budget brings direct relief here. The government has slashed the TCS rate for education and medical remittances from 5% down to 2%. This means more money stays in the pockets of families at the time of transaction, reducing the immediate financial burden of supporting students in London, New York, or Sydney.

Furthermore, for those planning family reunions or vacations, the tax on overseas tour packages has been dramatically simplified. The previous tiered system—which could climb as high as 20%—has been replaced with a flat, lower rate of 2%. This makes India-based travel bookings significantly more attractive for the diaspora and their resident relatives.

An ‘Olive Branch’ for Small Taxpayers: The Disclosure Scheme

For many NRIs, managing old bank accounts or small assets left behind in India (or acquired abroad while being a resident) has been a source of legal anxiety. To address this, the budget introduces the “Foreign Asset of Small Taxpayers Disclosure Scheme.”

This is essentially a one-time, six-month “amnesty” window. It allows small taxpayers to disclose overseas income or assets without the fear of heavy-handed penalties or long-term litigation. By providing this “fresh start” window, the government is signaling a shift toward a “Trust-Based Tax Administration,” encouraging voluntary compliance rather than focusing on punitive measures.

Coming Home: Easier ‘Transfer of Residence’

For the “Reverse Brain Drain” generation—those choosing to move back to India after years abroad—the budget has modernized the rules for bringing personal belongings home.

The “Transfer of Residence” rules, which govern how much furniture, electronics, and household goods a returning NRI can bring duty-free, are being expanded. Notably, the government has cleared the air on personal technology: travelers can now bring a new laptop as part of their personal effects without facing the customs hurdles that frequently caused delays at international terminals.

To further speed up the process, the Ministry of Finance is launching a dedicated online and app-based declaration system. Instead of filling out paper forms upon landing, NRIs can declare their goods and pay any applicable duties via their smartphones before they even board their flight.

Investing in the ‘New India’

For NRIs looking to invest in India’s booming startup and stock markets, the 2026 Budget removes several “speed bumps” that have historically frustrated foreign investors.

- Abolition of the ‘Angel Tax’: For years, the so-called “Angel Tax” created hurdles for NRIs wanting to invest in Indian startups. The 2026 Budget has officially abolished this tax for all classes of investors. This opens the gates for the diaspora to fund the next generation of Indian unicorns with far less paperwork.

- Dividend Ease: Handling the paperwork for dividends earned in India has often been a chore. The budget introduces a “Single Window Filing” system through depositories for Form 15G and 15H. This means NRIs can manage their tax exemptions on dividends and interest through a unified digital interface, rather than dealing with multiple banks or companies individually.

- Startup Extensions: The tax holiday for startups—many of which are founded or funded by the diaspora—has been extended to March 31, 2027. This provides the long-term “tax certainty” that international investors crave.

The “Safe Harbor” and Litigation Relief

One of the biggest deterrents for NRI business owners has been the fear of long-drawn-out tax disputes. The budget addresses this by expanding the “Safe Harbor” regime. By setting clear, pre-defined rules on how international transactions are taxed, the government is effectively promising that if you follow the rules, your tax filings will be accepted without question.

Additionally, for those who do find themselves in a dispute, the government has raised the monetary threshold for filing appeals. This means the tax department will no longer chase small, low-value cases through the courts, significantly reducing the “legal noise” for small-scale NRI investors and property owners.

Conclusion: A Budget of Belonging

The 2026-27 Union Budget marks a pivot from seeing the diaspora merely as a source of foreign exchange to treating them as vital partners in India’s growth story. By reducing the “tax on education,” simplifying customs for returning citizens, and removing the “Angel Tax,” the government has delivered a clear message: The door to India is wider, the rules are simpler, and the welcome is warmer.

For the millions of Indians living abroad, the “Ease of Living” promised in this budget isn’t just a political slogan—it’s a practical reduction in the cost and complexity of maintaining their bond with home.